The Future of Multi-Asset Finance

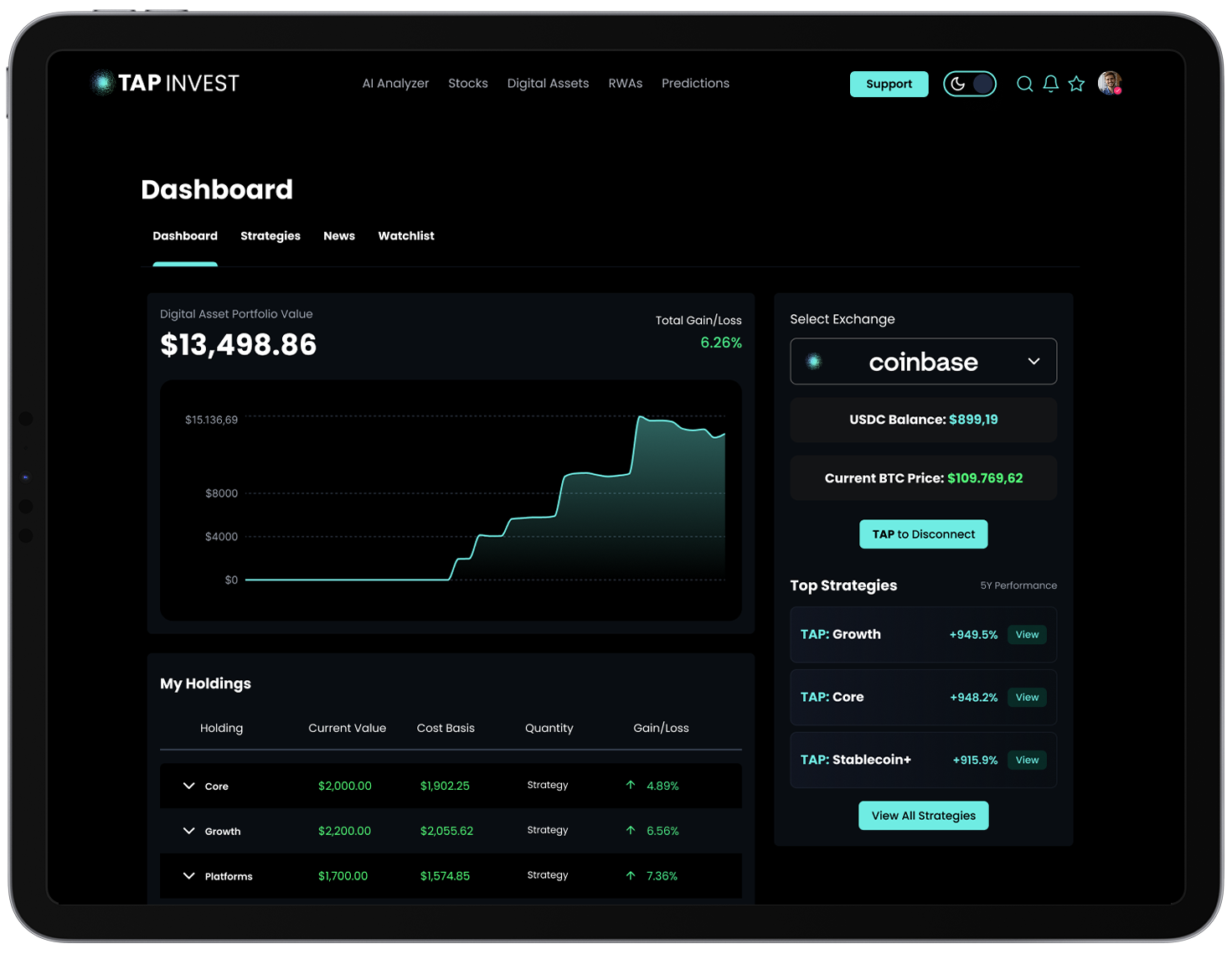

TAP Invest is an AI powered social trading platform that enables multi asset investing across stocks, crypto, and tokenized assets with automated trading strategies.

Explore stocks, mutual funds, ETFs, digital assets, real-world assets, and AI-driven strategies with TAP Invest, a unified platform designed for the next generation of investors.

Built on the Foundation of Global Markets

Access stocks, mutual funds, and ETFs within a unified investment experience.

Harness the power of AI

Analyze and empower your personal financial situation, portfolio and investments.

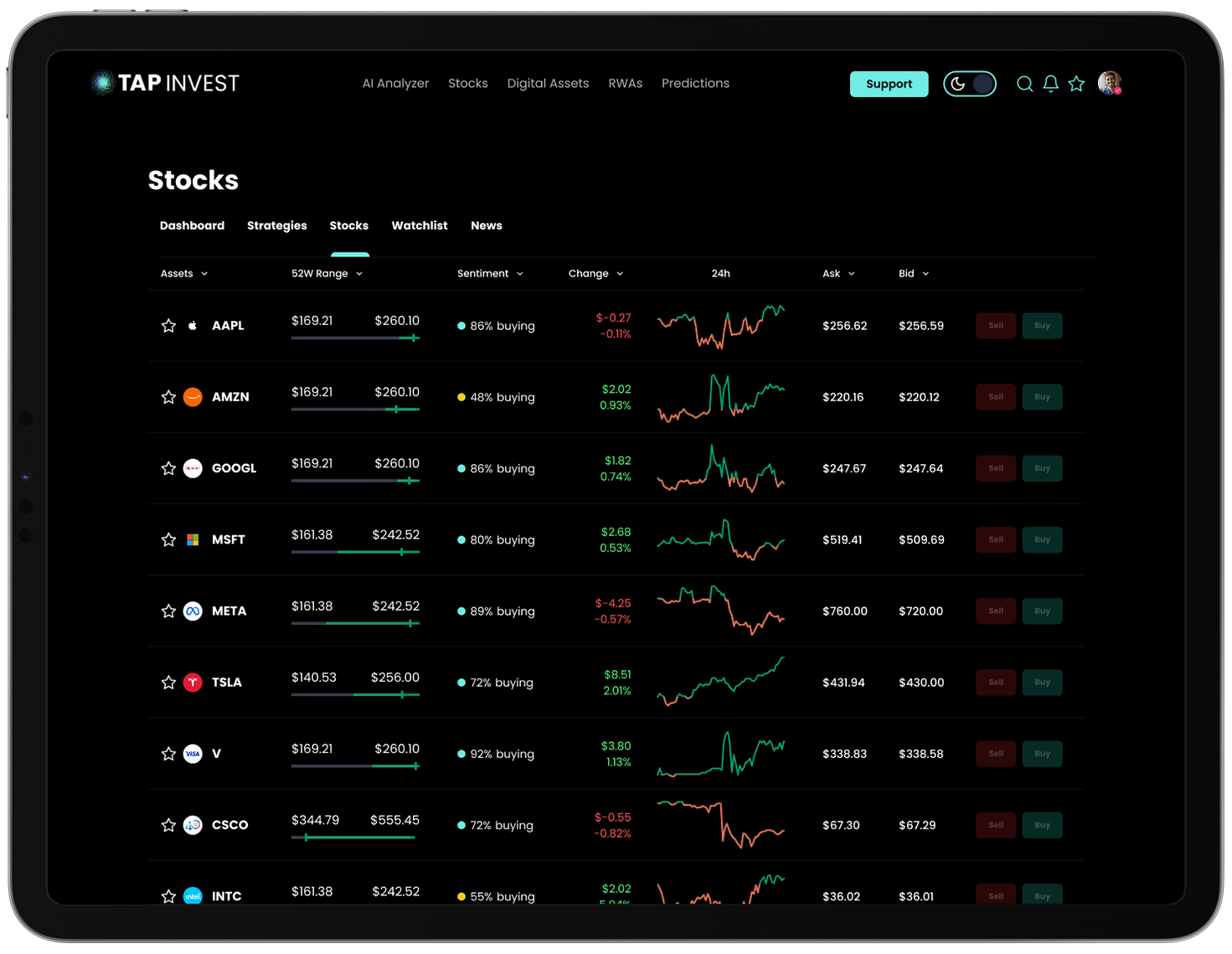

Stocks built for intelligent portfolio growth

Create personalized stock portfolios that adapt to market conditions and your goals. Using AI-driven analytics, the platform blends growth, value, and dividend strategies, helping you capture long-term performance while maintaining balanced risk across sectors and regions.

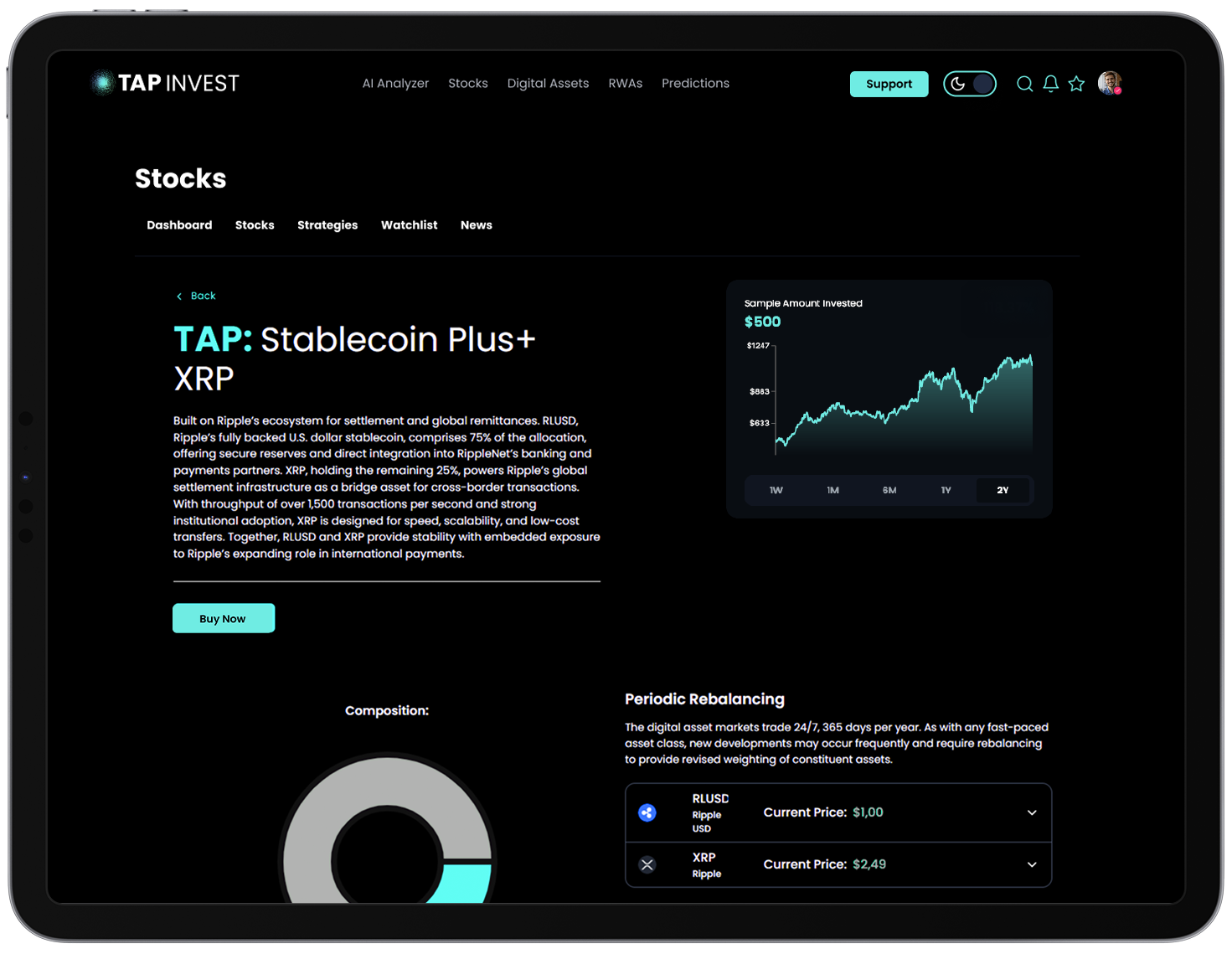

Digital assets powered by data and AI

Bring structure and intelligence to digital investing. Access Bitcoin, Ethereum, and leading blockchain ecosystems through curated, multi-asset portfolios designed for clarity, diversification, and real-time optimization. AI models continuously analyze trends, volatility, and sentiment to keep you positioned for what’s next.

Real world assets made accessible through tokenization

Bridge traditional and digital finance by giving investors access to tokenized gold, real estate, and private credit. These assets bring tangible value and income potential to your portfolio, with AI optimizing allocations for stability, inflation protection, and long-term wealth preservation.

How TAP Invest works

Create an TAP Invest account

Get started in minutes, set up your TAP Invest account quickly and securely to access both traditional and digital markets.

Link or fund wallet

Connect your existing brokerage or exchange accounts, or fund your account directly to start investing immediately.

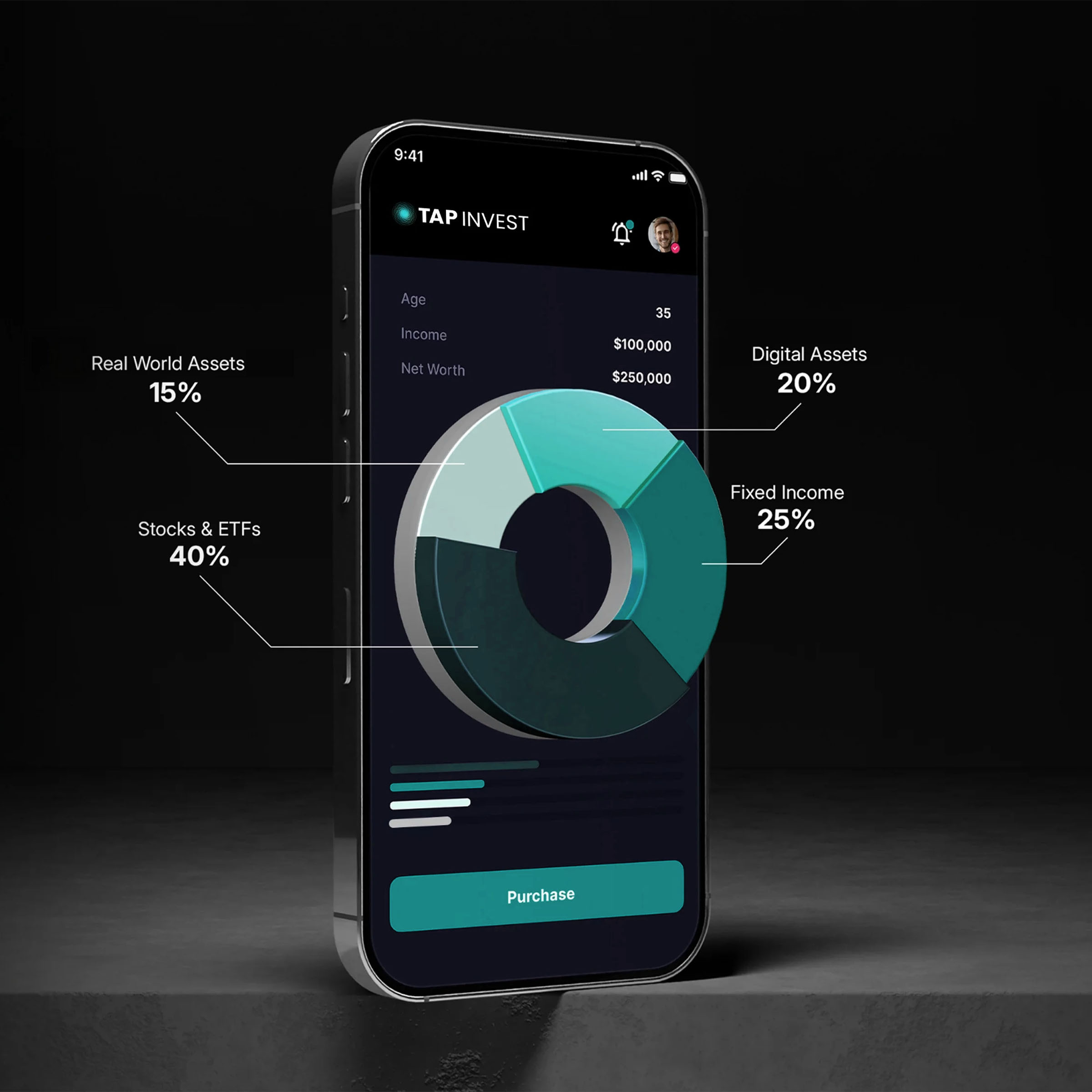

Choose a strategy

Select from AI-powered, multi-asset strategies designed to optimize growth, manage risk, and simplify your investment journey.

Expanded by the Digital Layer of Finance

Explore digital assets alongside traditional markets in one connected platform.

Where Real Assets Go Digital

View tokenized real-world assets with clear ownership context and transparency.

Built for a Multi-Asset World

Discover strategies designed to span asset classes and market conditions.

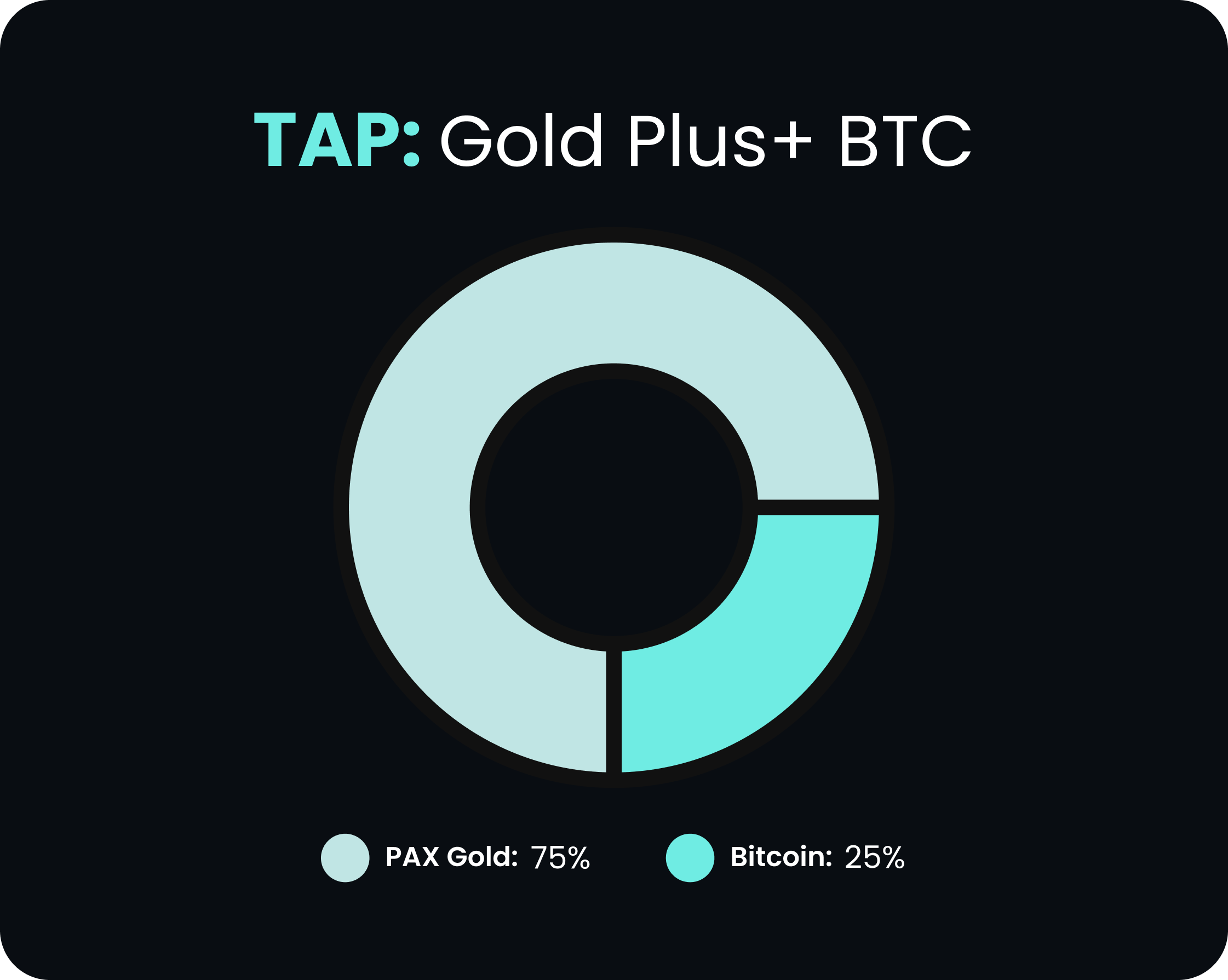

TAP: Gold Plus+ BTC

TAP: Gold Plus+ BTC unites the world’s most enduring store of value with the leading digital reserve asset. For centuries, gold has been the benchmark of intrinsic value and safe-haven stability. Represented by PAXG, gold anchors the strategy as a core inflation hedge and wealth preservation instrument, backed by LBMA-certified gold reserves stored in institutional vaults.

Bitcoin complements this allocation with 25%, serving as the first digitally scarce asset with a fixed supply of 21 million, deep liquidity, and accelerating institutional adoption.

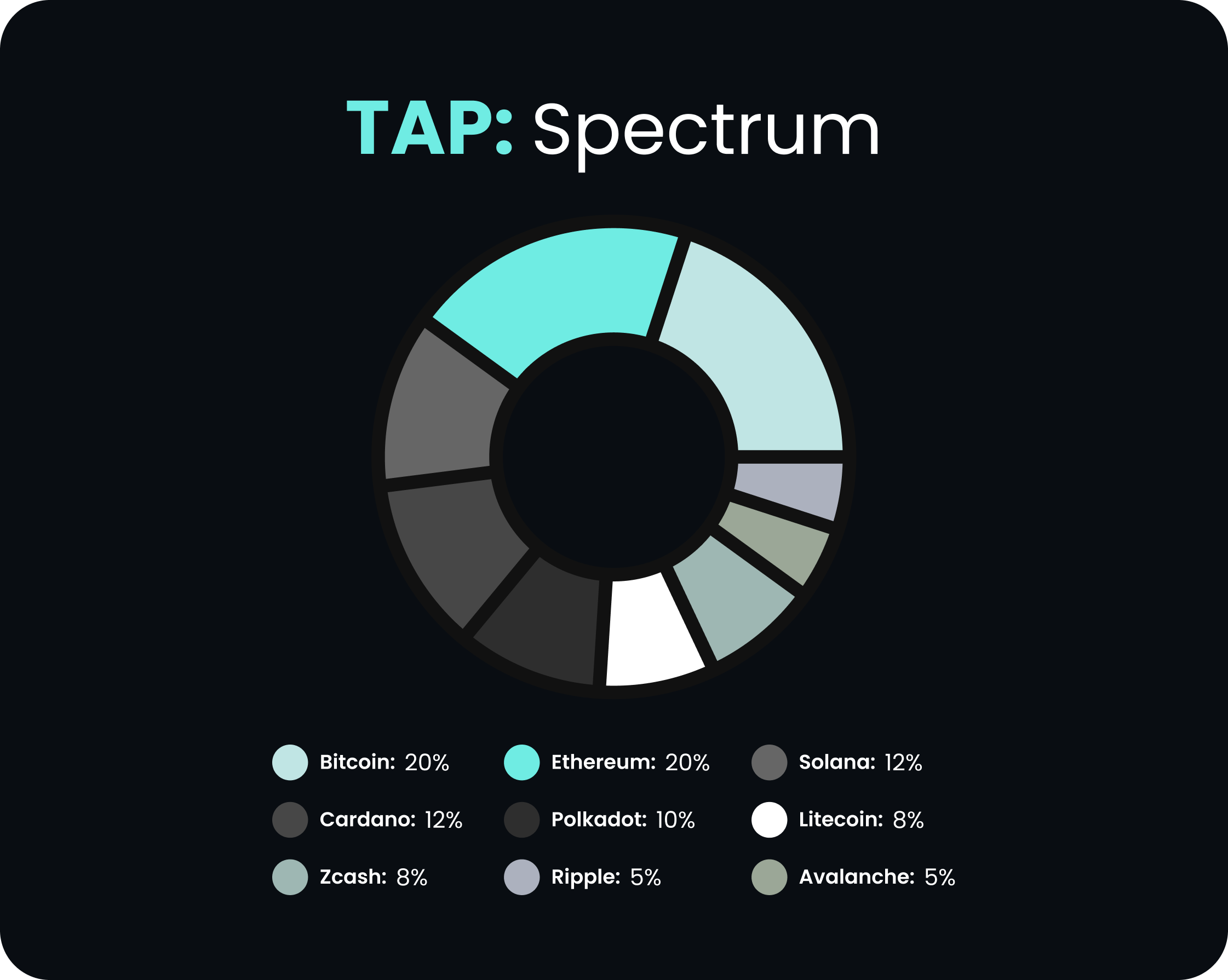

TAP: Spectrum

TAP: Spectrum offers maximum diversification across Layer 1 protocols, interoperability frameworks, scaling solutions, and payment networks. BTC and ETH anchor the portfolio for adoption leadership. SOL, ADA, and DOT provide broad Layer 1 coverage with different consensus and scaling approaches. LTC adds a proven, fast-settlement asset with strong multi-chain integration and payment adoption. ZEC adds a zero-knowledge, privacy-preserving asset for secure transactions. XRP delivers high-speed cross-border payments with low fees. AVAX supports an interoperable multi-chain blockchain internet.

This basket positions investors to capture upside across the most important sectors of the digital asset economy, while significantly reducing concentration risk by spreading exposure across nine high-conviction assets.

Intelligence for Modern Investing

Analyze assets and portfolios using AI-powered insights and clear explanations.

AI Investing Platform: How It Works

AI Investing Platform: How It Works

TapInvest is an AI investing platform built to simplify modern investing. Instead of relying only on manual research, the platform uses AI powered portfolio analysis to review market data, asset performance, and risk exposure in real time.

The system looks at trends across stocks, crypto, and other digital assets to help users make clearer allocation decisions. It is designed to support smarter diversification and more disciplined portfolio management without adding complexity.

Stocks & Crypto trade : All In One Place

Stocks & Crypto trade : All In One Place

TapInvest supports multi asset investing, so users can trade crypto and stocks in one place. Rather than switching between different apps, investors manage everything inside a single dashboard.

This approach makes it easier to monitor performance, adjust allocations, and keep a balanced portfolio across traditional and digital markets.

Social Trading System

Social Trading System

The platform includes social trading features that allow users to follow strategies, view performance insights, and learn from other investors.

This community driven investing model gives individuals more visibility into how portfolios are structured and managed, helping them make more informed decisions.

Automated / One Tap Strategies

Automated / One Tap Strategies

TapInvest offers automated trading strategies designed to reduce manual work and emotional decision making. Users can apply one tap strategies that automatically align their portfolios with predefined models.

These tools are built for investors who want structured execution without constantly adjusting individual trades.

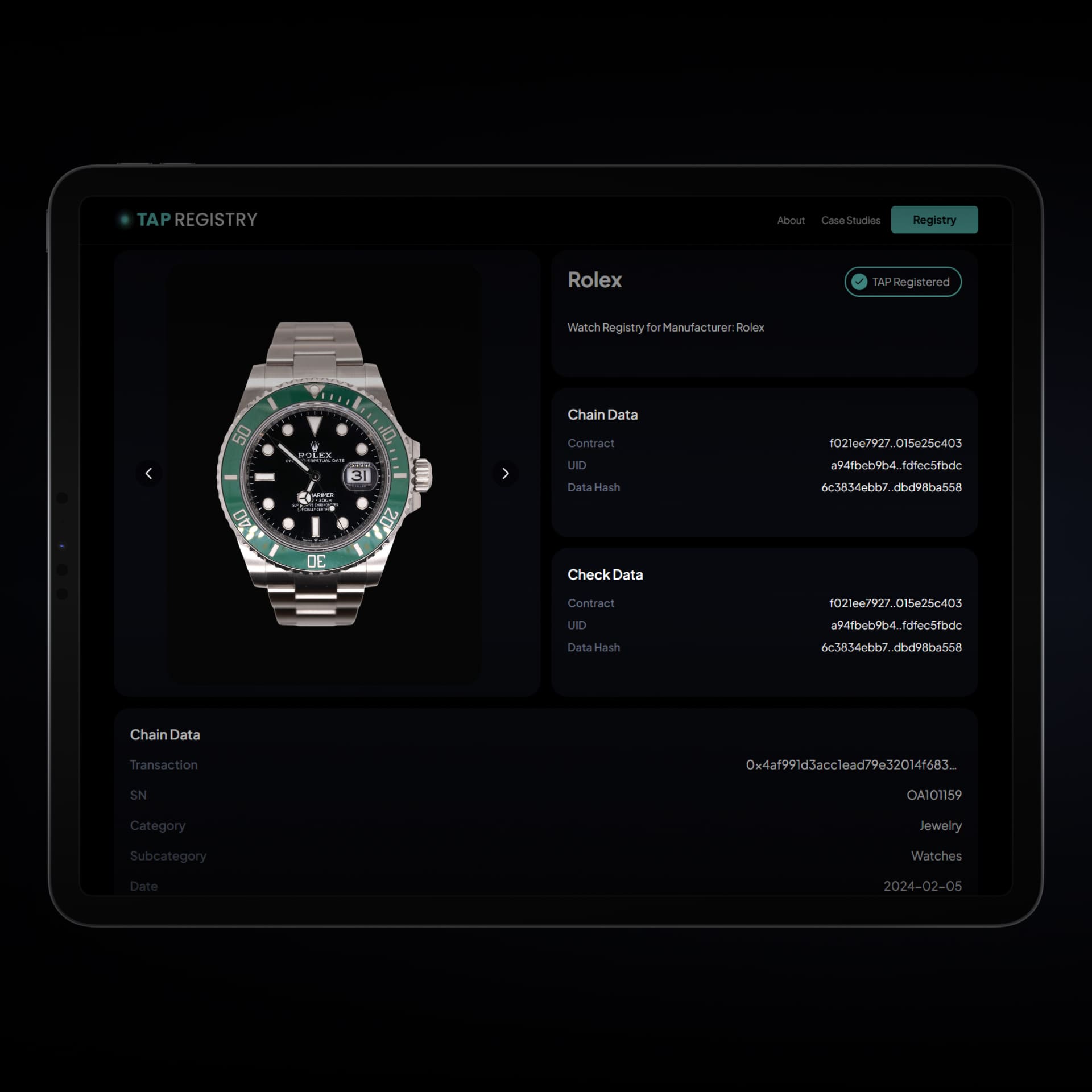

Tokenized Assets & Fractional Ownership

Tokenized Assets & Fractional Ownership

Through asset tokenization, TAP Invest enables access to tokenized assets that represent fractional ownership in underlying investments.

Fractional ownership makes it easier for investors to participate in diversified opportunities without needing large capital commitments, while maintaining transparency in asset structure.

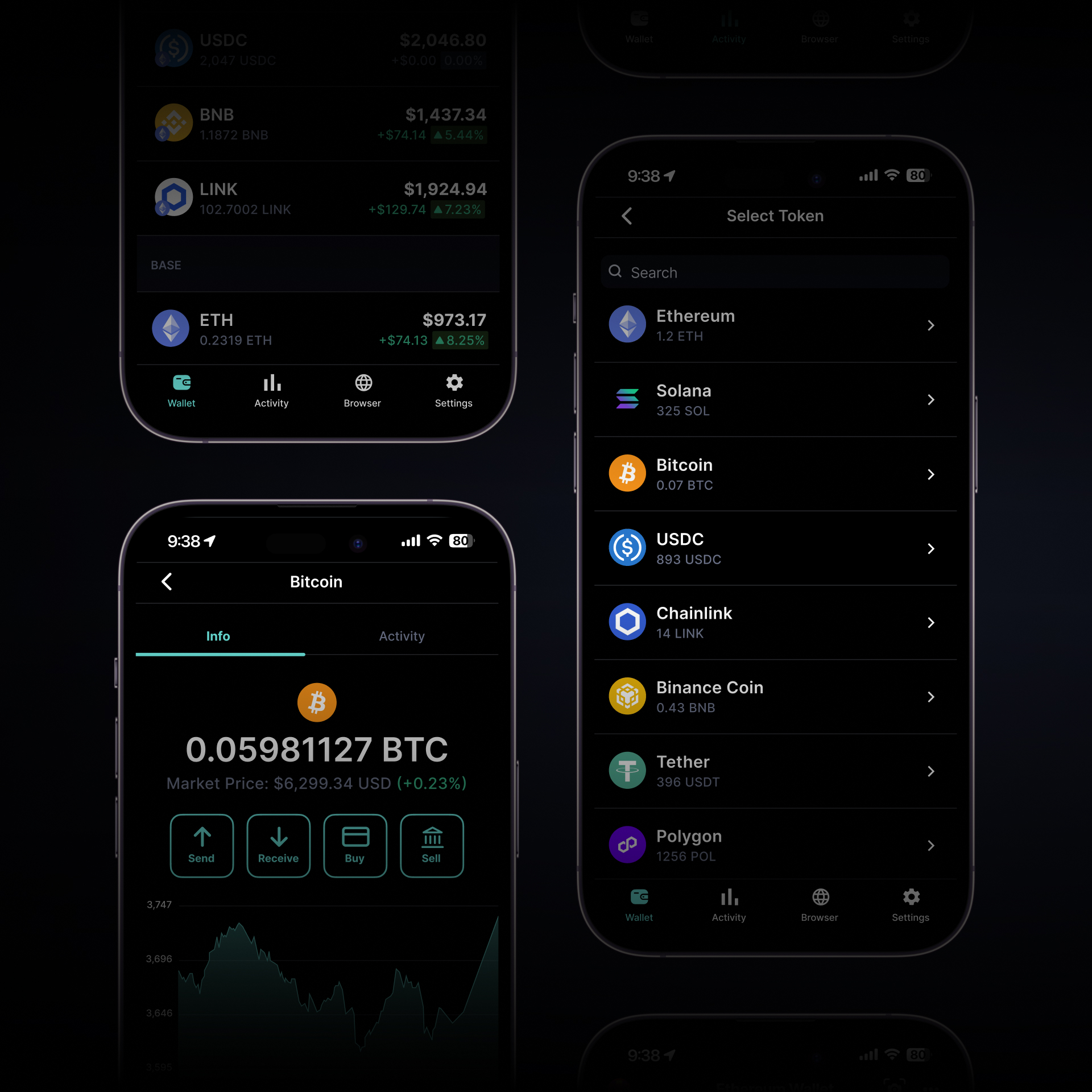

Secure Crypto Wallet

Secure Crypto Wallet

TapInvest includes a secure crypto wallet and digital wallet infrastructure designed with encryption and custody protections.

User assets are safeguarded through secure authentication processes and structured custody systems built to meet modern compliance expectations.

FAQ Section

FAQ Section

What is an AI investing platform?

An AI investing platform uses data analysis and automation to help investors evaluate portfolios, manage risk, and make allocation decisions more efficiently.

How does AI powered portfolio analysis work?

It reviews market trends, asset correlations, and volatility patterns to provide insights that support diversification and risk management.

Can I trade crypto and stocks in one place?

Yes. TapInvest supports multi asset investing, allowing users to trade crypto and stocks in one place through a unified dashboard.

What is social trading?

Social trading allows investors to observe, follow, and learn from the strategies of other participants within the platform.

What are automated trading strategies?

Automated trading strategies execute portfolio adjustments based on predefined rules instead of manual order placement.

What are one tap strategies?

One tap strategies allow users to apply structured model portfolios with a single action.

What are tokenized assets?

Tokenized assets are digital representations of investments that enable fractional ownership through blockchain based structures.

Is TapInvest secure?

TapInvest integrates encryption, secure authentication, and custody systems to help protect user accounts and digital assets.