TLDR: The “Debasement Trade” refers to the growing concern that governments are printing record amounts of money, causing the U.S. dollar’s purchasing power to erode and prompting investors to seek alternative assets like Bitcoin, gold, and tokenized real-world assets to preserve value. With national debt surpassing $37 trillion and the dollar experiencing its steepest decline in decades, capital is shifting toward diversified stores of value as traditional markets reach record highs. TAP’s mission is to help investors of all levels access these opportunities through simple, one-TAP solutions that support multi-asset diversification. In a world where inflation, currency devaluation, and macroeconomic shifts are reshaping finance, building resilient portfolios across asset classes—from hard assets and digital tokens to stablecoins and collectibles—has become essential for protecting long-term wealth.

TLDR: The “Debasement Trade” refers to the growing concern that governments are printing record amounts of money, causing the U.S. dollar’s purchasing power to erode and prompting investors to seek alternative assets like Bitcoin, gold, and tokenized real-world assets to preserve value. With national debt surpassing $37 trillion and the dollar experiencing its steepest decline in decades, capital is shifting toward diversified stores of value as traditional markets reach record highs. TAP’s mission is to help investors of all levels access these opportunities through simple, one-TAP solutions that support multi-asset diversification. In a world where inflation, currency devaluation, and macroeconomic shifts are reshaping finance, building resilient portfolios across asset classes—from hard assets and digital tokens to stablecoins and collectibles—has become essential for protecting long-term wealth.

You may have read recently about something called the “Debasement Trade” and wondered what it means. In simple terms, it means governments are printing record amounts of money, national debt is at historic highs, every new dollar in circulation buys a little less than it did before

The impact is simple: U.S. dollar purchasing power is eroding in real time, and investors are being forced to rethink how they protect their money by looking towards more diversified asset classes that may better preserve value over time.

A record-high U.S. stock market, the flight of wealth into expensive stores of value like gold, and the steady erosion of the dollar’s purchasing power for middle-class families and wage earners all point to the same reality: the wealth gap is widening, and the disconnect between the top 1% and everyone else is growing deeper.

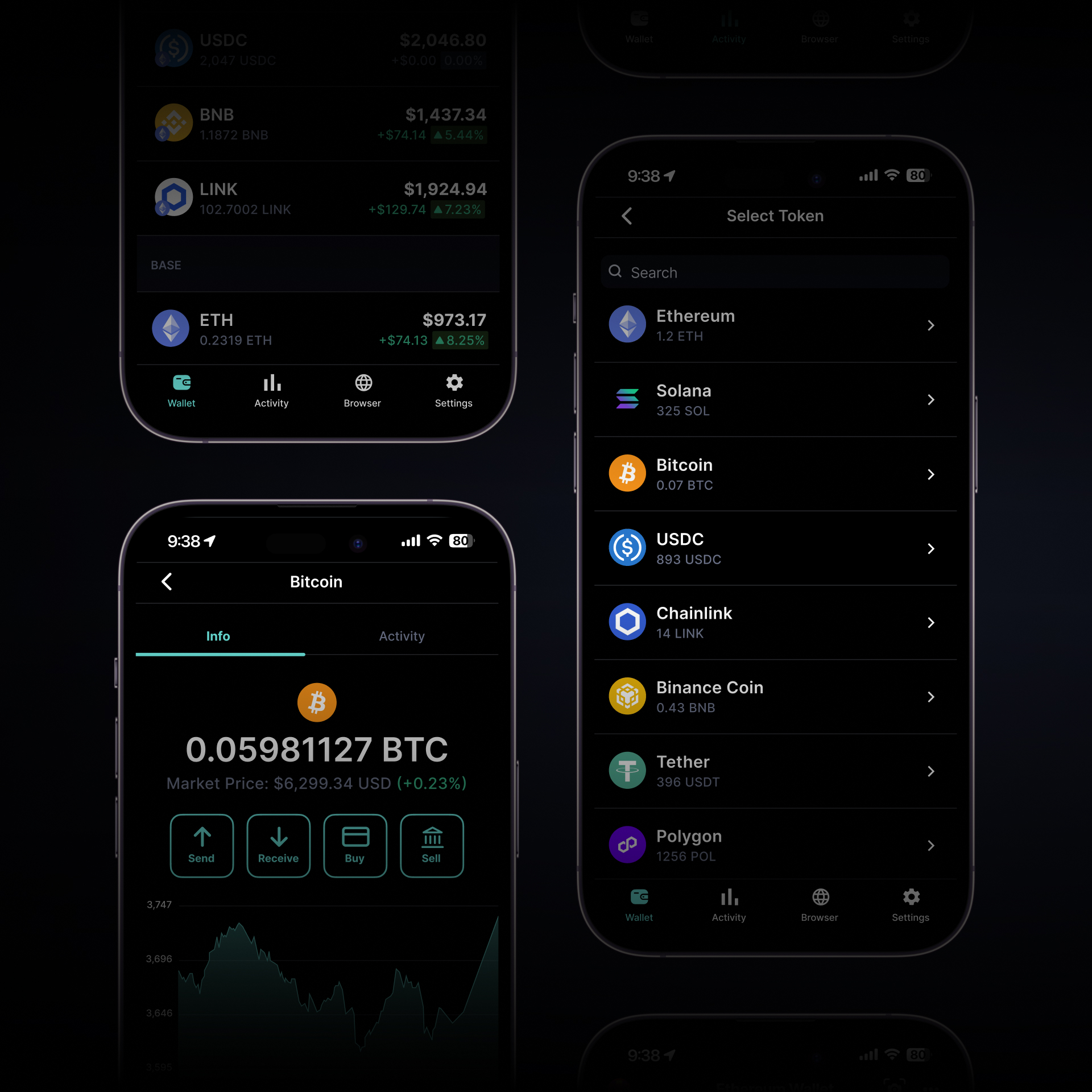

At TAP, we believe it’s critical to change that trajectory. Our goal is to create simple, one-tap access points and strategies that give all investors the ability to participate in these major economic shifts, rather than be left behind by them.

Why the Debasement Trade Is in Focus Now

A number of macro trends underscore why the debasement trade is in focus and, additionally, why alternative assets, such as Bitcoin and gold, are coming into focus for portfolio diversification:

- U.S. total gross national debt has surpassed $37.85 trillion, over $2 trillion higher than it was just one year ago. Joint Economic Committee

- The U.S. dollar’s historic decline in 1H 2025. Morgan Stanley reports the U.S. dollar fell ~11% in the first half of 2025, marking its worst 1H performance since 1973. Morgan Stanley

- Forecasts of further U.S. dollar weakening. The same Morgan Stanley team sees continued depreciation ahead, projecting as much as ~10% additional loss through 2026. Morgan Stanley

- Shifting institutional narrative. Goldman Sachs Asset Management frames 2025 as a possible inflection—a turning point that may drive greater diversification away from dollar-only allocations. The Dollar’s Shifting Landscape: From Dominance to Diversification

- Media coverage of the debasement trade is increasing across U.S. domestic and global outlets. Business Insider

- Bitcoin is scarce by design. Unlike fiat currencies subject to expansion, Bitcoin’s supply is fixed (capped at 21 million BTC) and is hovering well over $100,000 per Bitcoin as of October 17, 2025.

- Gold breached $4,300 per ounce for the first time, marking a fresh all-time high on October 17, 2025. The precious metal “has surged more than 64% year to date,” underscoring the aggressive shift of capital into alternative stores of value. Reuters

Why Portfolio Diversification Matters

While currency-pegged stablecoins, upon which $27 trillion was transferred last year, exceeding Visa and Mastercard combined, deliver new methods for reducing the cost of money using patented technologies such as TAP’s “System and Method for Transferring Currency Using Blockchain” (U.S. Patent No. 12,118,613 B2, Foote et al.), it is also important that customers consider branching out past just U.S. dollars into diversification across additional currencies and asset classes.

While no single hedge works perfectly across every inflationary cycle, diversification across asset classes, geographies, and currencies can provide a buffer against systemic shocks, devaluation, and policy shifts. In a world where macroeconomic dynamics are being rewritten in real time, multi-asset diversification has become a critical element of portfolio construction.

Rethinking Portfolio Construction across Multiple Asset Classes

Investors today have more tools than ever to hedge against currency erosion. No single asset class guarantees protection. A resilient portfolio should consider diversification through hard assets, digital stores of value, income-generating instruments, inflation-sensitive equities, and more to preserve purchasing power over time.

Blockchain tokenization will likely only increase the inflows, and potentially the value, of these alternative asset classes over time.

- Stocks: Ownership of public companies in sectors like energy, commodities, and infrastructure.

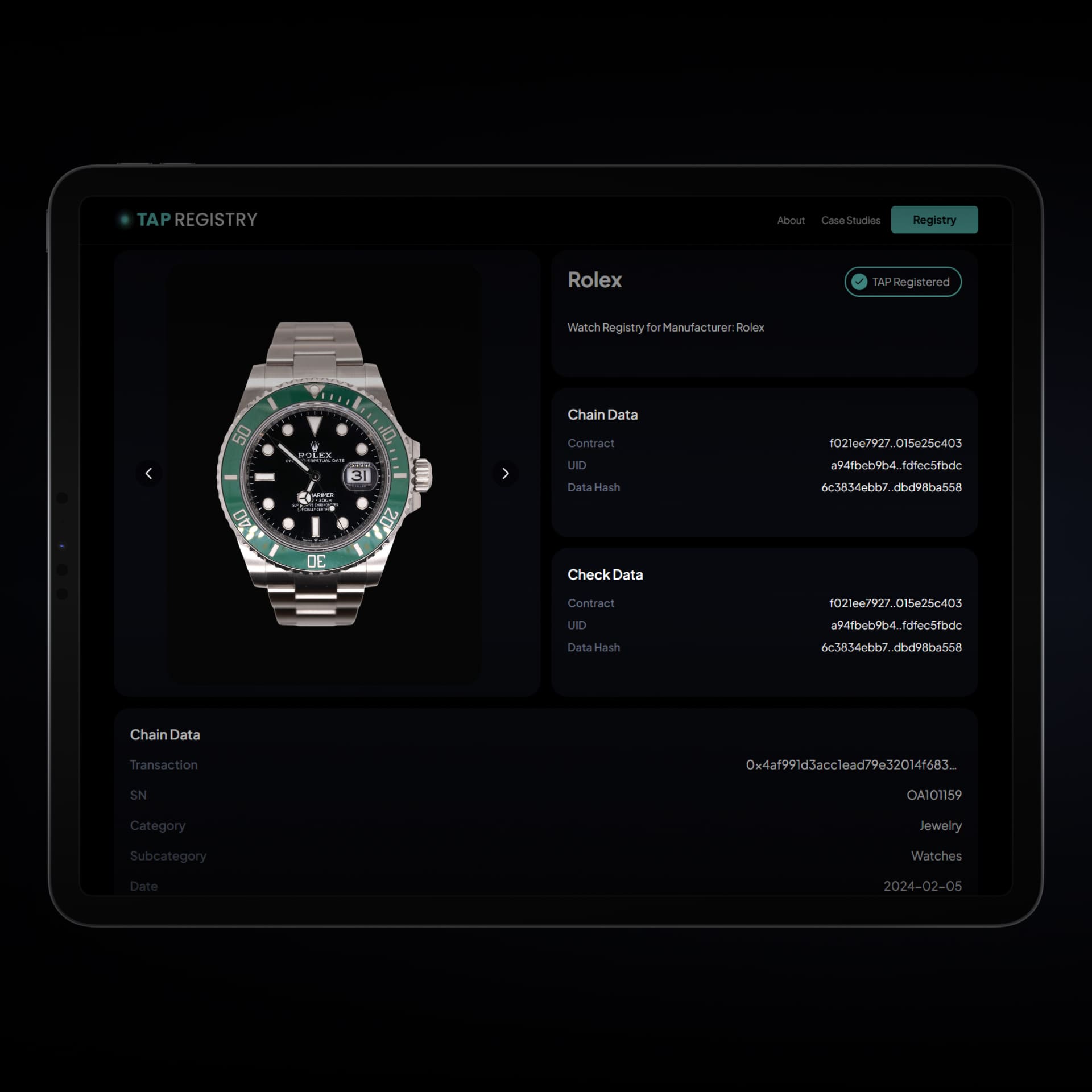

- Real Estate and Real-World Assets (RWAs): Provide intrinsic utility, rental income, and appreciation potential; tokenization increases liquidity and fractional ownership.

- Stablecoins with Yield: Enable dollar exposure while earning return through DeFi or regulated on-chain yield markets; serve as an on-ramp between fiat and hard assets.

- Collectibles: Increasingly, fine art, vintage watches, rare cars, luxury goods, and sports memorabilia are being tokenized, creating new liquidity, fractional ownership for less expensive investor entry points, and secondary-market opportunities.

- Bitcoin and Digital Assets: Offer decentralized scarcity and programmable liquidity; often act as a high-beta hedge against fiat debasement and monetary expansion.

- Gold, Silver, and Precious Metals: Time-tested stores of value that typically outperform during inflationary or low-trust monetary regimes.

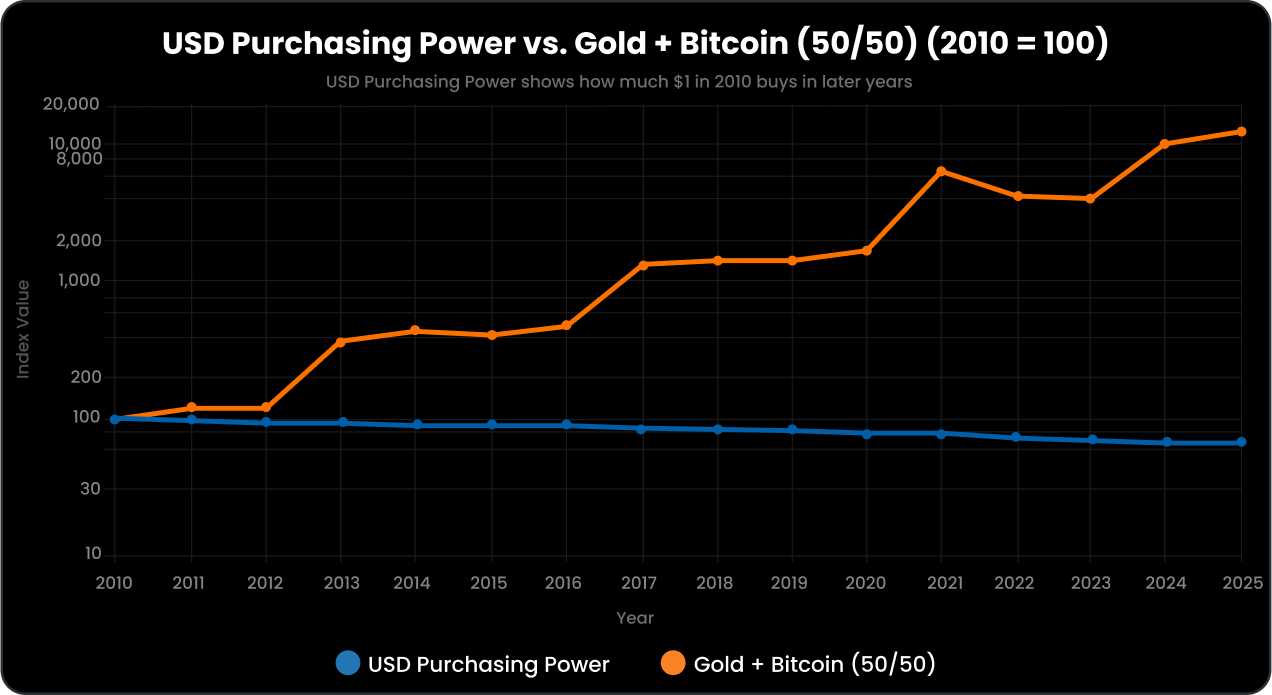

Over the past 15 years, from October 2010 to October 2025, the value of the U.S. dollar has moved in stark contrast to a simple 50/50 blend of Bitcoin and gold.

If you look at the chart, the blue line represents the dollar’s purchasing power, adjusted for inflation. It’s been a slow and steady slide, down about 35% since 2010. In other words, what cost $1 back then now takes about $1.50 to buy today.

The orange line, on the other hand, shows what would have happened if you’d invested $1,000 back in 2010 and split it evenly between gold and Bitcoin, rebalancing once a year. That mix would be worth more than $126,000 today, thanks to Bitcoin’s massive growth over this time period and gold’s consistent strength vs. the U.S. dollar.

The takeaway is simple: while everyday prices have risen and the dollar’s buying power has eroded, hard assets, especially when combined with digital ones, have dramatically outpaced inflation over time over the last decade and more.

Why The Decline of the U.S. Dollar Matters For Your Portfolio

Holding solely U.S. dollars has meant a decline in purchasing power compared to a diversified portfolio. For investors, this highlights the potential value of diversifying into assets with scarcity, like gold and Bitcoin, to hedge against inflation and protect long-term wealth.

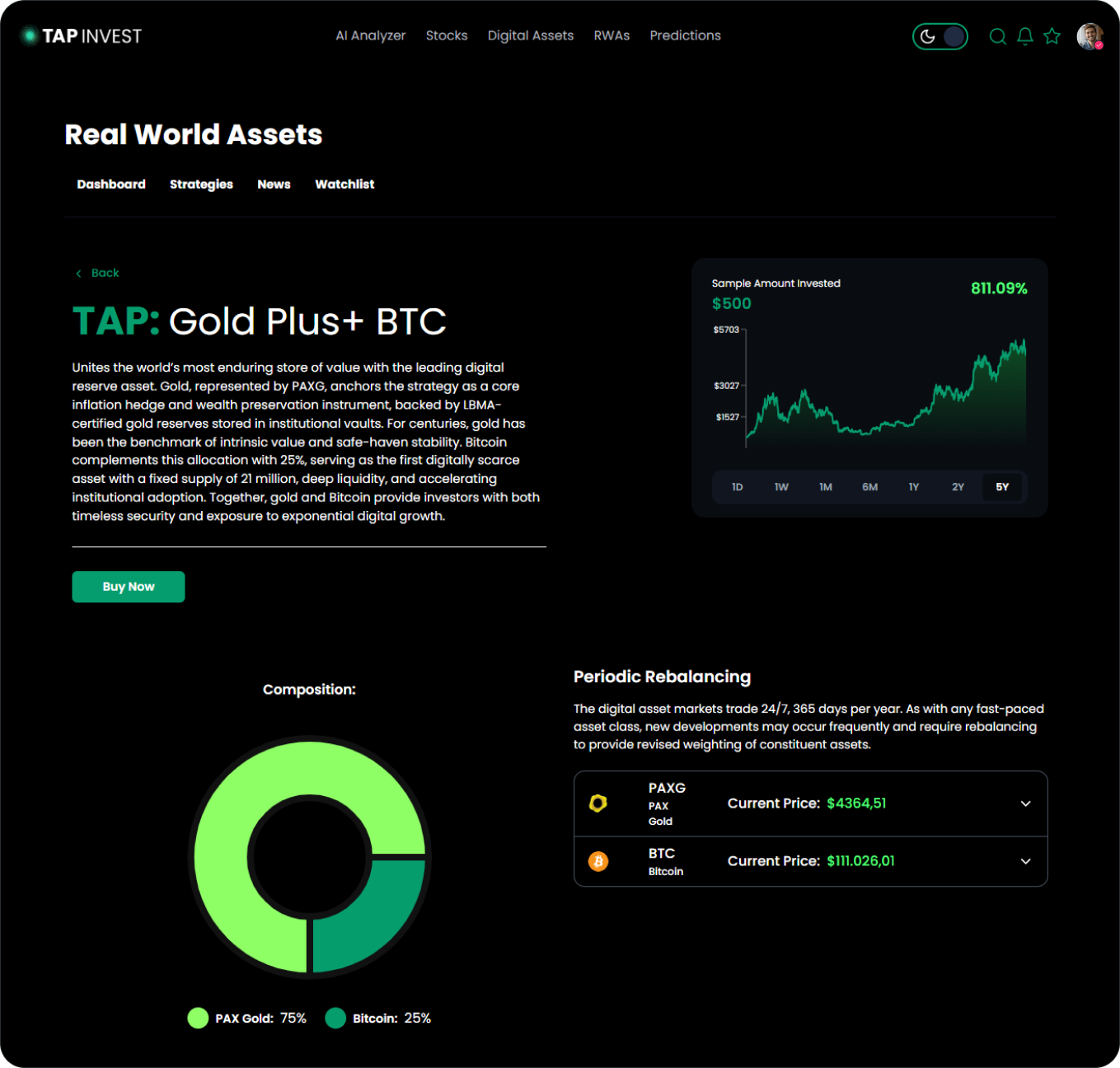

To make this simple for clients, TAP Invest offers strategies such as our TAP: BTC + Gold—a structured allocation of blockchain tokenized assets, designed to balance the volatility of digital scarcity with the stability of physical metal, creating a modern hedge for your portfolio.

Final Thoughts

At TAP, our mission is to identify major market shifts and deliver one-TAP portfolio strategies that empower customers to take decisive action. In today’s market environment, that means helping U.S. investors defend their portfolios against inflation, declining purchasing power, and ongoing currency debasement, all unfolding in real time.

The debasement trade is no longer a theoretical concept; it is a measurable economic reality, reflected in the data across debt, inflation, and asset markets. The question is no longer if it continues, but rather how investors will adapt to it.

Brian Foote—CEO, TAP, Inc.

References:

-

- Business Insider. What to Know About Wall Street’s Hottest Trade Designed to Guard Against Global Economic Chaos. October 2025. “Investors are piling into what’s being called the ‘Debasement Trade’—a rush into gold, silver, and bitcoin as hedges against currency devaluation and record levels of government debt.” Source: businessinsider.com

- Joint Economic Committee (U.S. Congress). National Debt Increases Almost $69,000 per Second. October 3, 2025. “As of October 3, 2025, total gross national debt is $37.85 trillion, which is $2.17 trillion higher than one year ago.” Source: jec.senate.gov

- Morgan Stanley. The Depreciation of the Dollar. October 2025.

“The U.S. dollar ended the first half of 2025 with its biggest loss since 1973 … Morgan Stanley expects further losses ahead.” Source: morganstanley.com - Goldman Sachs Asset Management. The Dollar’s Shifting Landscape: From Dominance to Diversification. 2025. “2025 marks a potential inflection point … a shift in sentiment that may prompt greater diversification in asset allocation.” Source: goldmansachs.com

- Reuters. Gold Rallies Beyond $4,300/oz, Set for Best Week in Five Years. October 17, 2025.

“Gold hit a record high above $4,300 per ounce … has surged more than 64% year to date as investors flocked to safe-haven assets amid geopolitical tensions and de-dollarization.” Source: reuters.com

- Cointelegraph. Stablecoins Surpass Visa and Mastercard in Global Transaction Volume. March 2025. “Stablecoin settlement volumes reached $27.6 trillion in 2024, exceeding Visa and Mastercard combined, signaling a paradigm shift in digital money movement.” Source: https://cointelegraph.com/news/stablecoins-beat-visa-mastercard-2024-volume

- USPTO: System and Method for Transferring Currency Using Blockchain.

U.S. Patent No. 12,118,613 B2 (Brian McLaren Foote et al.). Issued October 15, 2024. Source: US12118613B2 – System and method for transferring currency using blockchain – Google Patents

Legal Disclaimer:

Please conduct your own due diligence and consult a licensed financial advisor before making investment decisions. This content is for informational and educational purposes only and does not constitute investment advice.