TLDR: The traditional 60/40 portfolio—once the gold standard for balanced investing—is losing relevance in today’s volatile, inflationary, and tech-driven world. Rising debt, currency instability, and shifting correlations between stocks and bonds have eroded its reliability as a diversification model. Modern investors are expanding beyond equities and fixed income to include digital assets, tokenized real-world assets (RWAs), commodities, and alternative strategies that perform differently across market cycles. Platforms like TAP Invest enable this evolution by offering seamless access to both traditional and blockchain-native markets, supported by AI-driven insights and multi-asset strategies. The future of portfolio construction lies not in abandoning the 60/40 model but in rethinking diversification for resilience in a rapidly changing financial landscape.

TLDR: The traditional 60/40 portfolio—once the gold standard for balanced investing—is losing relevance in today’s volatile, inflationary, and tech-driven world. Rising debt, currency instability, and shifting correlations between stocks and bonds have eroded its reliability as a diversification model. Modern investors are expanding beyond equities and fixed income to include digital assets, tokenized real-world assets (RWAs), commodities, and alternative strategies that perform differently across market cycles. Platforms like TAP Invest enable this evolution by offering seamless access to both traditional and blockchain-native markets, supported by AI-driven insights and multi-asset strategies. The future of portfolio construction lies not in abandoning the 60/40 model but in rethinking diversification for resilience in a rapidly changing financial landscape.

The traditional 60/40 portfolio, 60 percent stocks and 40 percent bonds, has long been the foundation of balanced investing. The idea was simple: diversification across equities and fixed income could smooth returns over time, combining growth with stability. For decades, this framework worked well in an environment of falling interest rates, moderate inflation, and steady economic expansion.

But that world is changing. Inflation, geopolitical tension, shifting monetary policy, and currency volatility have disrupted the balance between these core asset classes. Diversification through stocks and bonds alone no longer provides the same level of protection or performance. Investors are rethinking what it means to be truly diversified in a complex, rapidly evolving global economy.

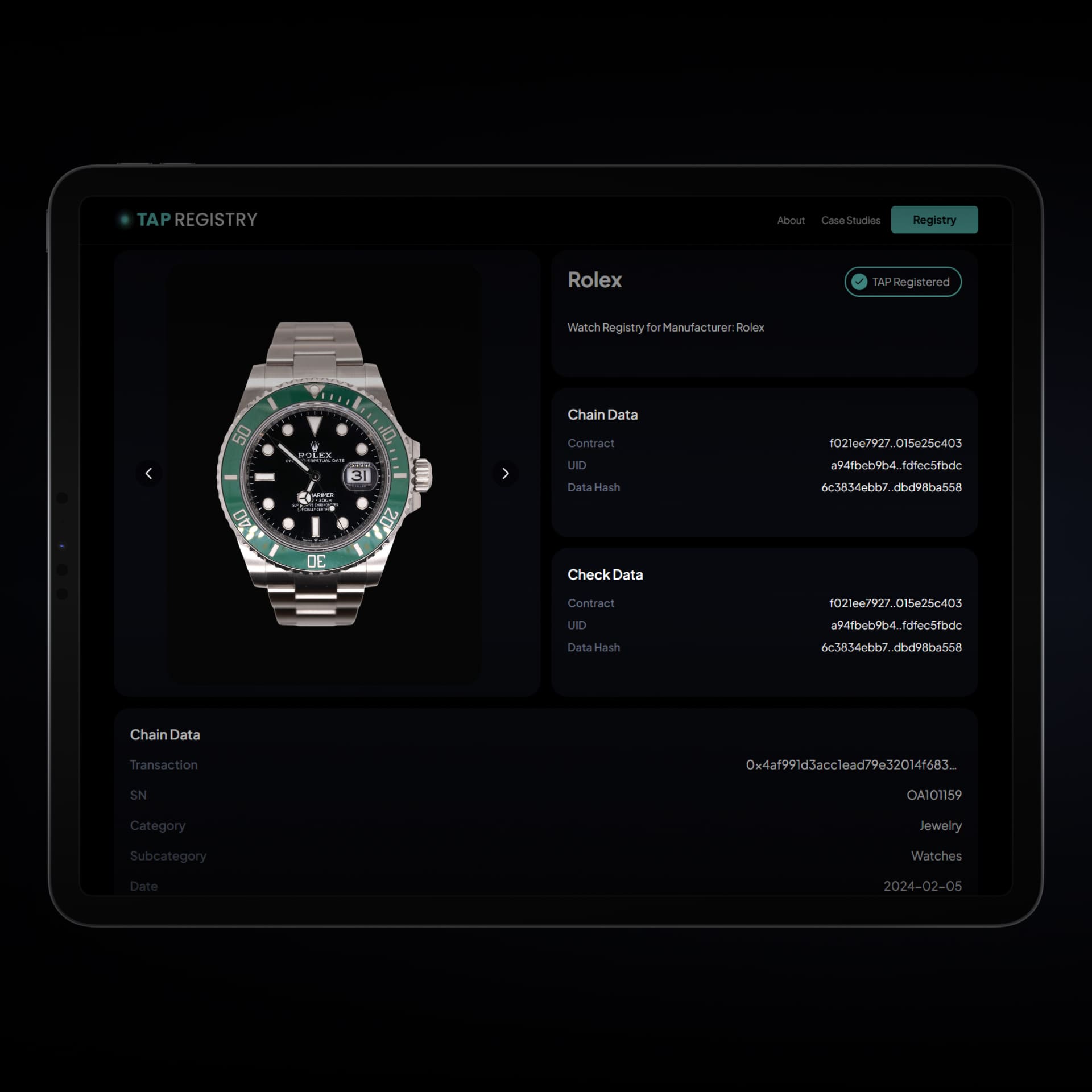

In addition to these macro changes, new technologies are reshaping how portfolios are built. The blockchain tokenization of assets, from equities and real estate to commodities and private credit, is driving greater access, liquidity, and strategy innovation.

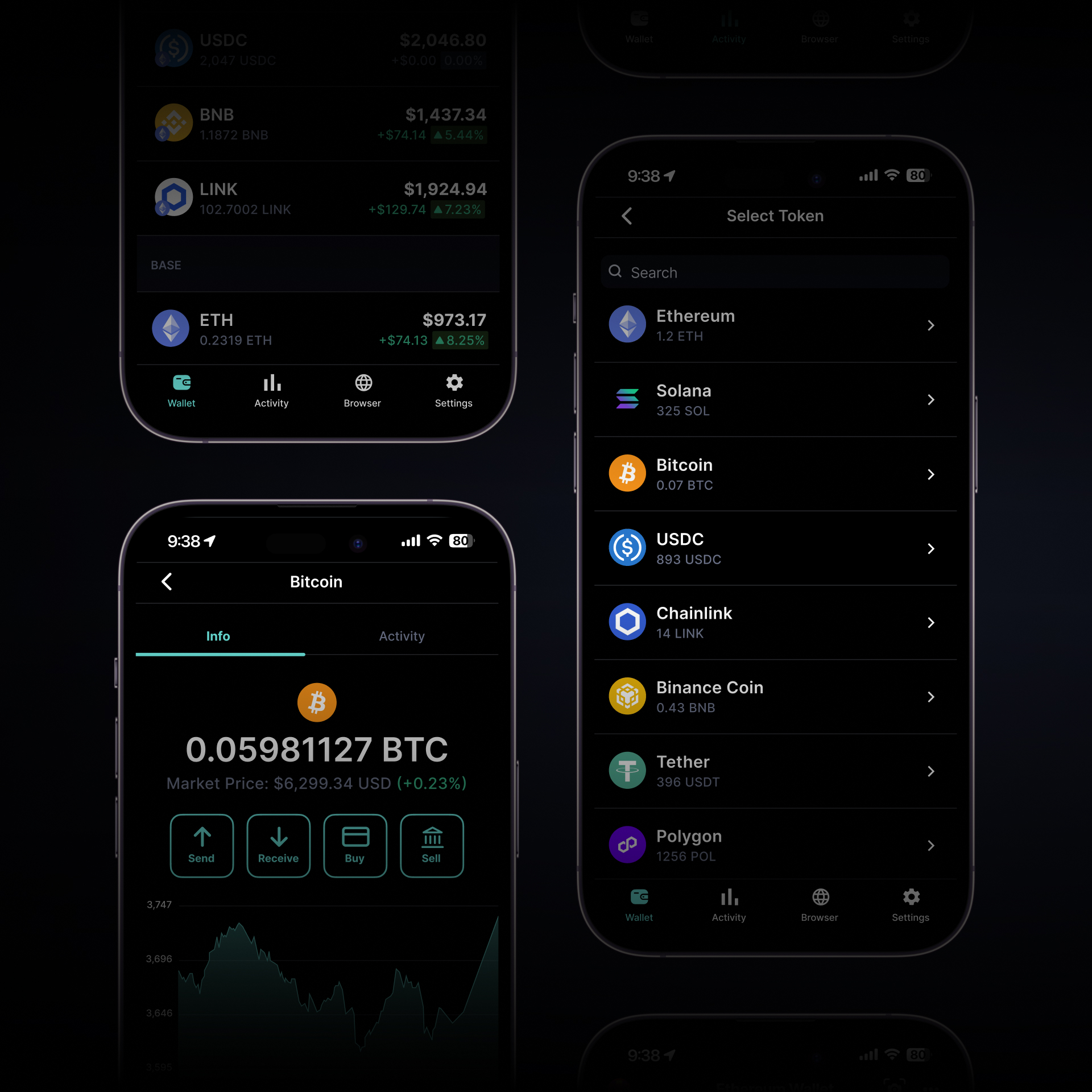

Investors can now move beyond the traditional stock-bond mix to build multi-asset portfolios that include digital assets, tokenized real-world assets (RWAs), and more on platforms such as TAP Invest.

Why the 60/40 Portfolio Is Becoming Outdated

The assumptions that once supported the 60/40 model are under strain, ranging from regime changes in market signals to technology, valuations, and expanded access to asset classes.

Alternative assets are outperforming: Bitcoin, gold, art, and private credit have all delivered strong, risk-adjusted returns with distinct behavior from traditional markets over the past decade.

Blockchain tokenization will transform access: Digital infrastructure now allows both institutional and retail investors to access and trade multiple asset classes seamlessly. This transformation may drive major inflows into previously illiquid markets.

Currency supply and debt levels are rising: Government debt and fiscal expansion have reached record highs, undermining fiat currencies as long-term stores of value.

Institutions Are Also Re-Evaluating Traditional Portfolio Construction

Traditional portfolios are also struggling to maintain attractive Sharpe ratios, as correlations across major asset classes increase and volatility remains elevated. True diversification today requires non-correlated and uncorrelated assets that behave differently across cycles, spanning traditional, digital, and real-world markets.

As J.P. Morgan Private Bank notes, “Inflation above 2 percent often causes stocks and bonds to move in tandem … We believe investors need to look beyond just stocks and bonds to build resilient portfolios.” ¹

Morgan Stanley observes that “Concerns about the widely used 60/40 strategy aren’t unfounded … exactly how one thinks about the right mix of equities and bonds … may need to change.” ²

BlackRock has cautioned that “Heightened fiscal, trade, and policy dynamics challenge the performance, stability, and diversification potential of 60/40 portfolios.” ³

Meanwhile, the rise of on-chain assets and tokenized yield products provides real-time visibility into market dynamics. Global liquidity flows, on-chain transaction volumes, and digital asset price action can now inform allocation decisions faster and more transparently than ever before, allowing new platforms like TAP Invest and automated TAP Strategies to step in and serve global retail customers in new and dynamic ways across multiple asset classes.

Rethinking Allocation: From 60/40 to Multi-Asset Resilience

The goal isn’t to abandon equities or fixed income but to build around them with assets that perform differently in stress environments, those that can preserve value when inflation rises, currencies weaken, or policy conditions shift.

Portfolio allocations must now balance not only volatility and return but also exposure to different monetary regimes, policy environments, and sources of real-world value. The objective is to optimize risk-adjusted returns, targeting stronger Sharpe ratios through multi-asset diversification and real-time, data-driven adjustments.

How TAP Invest Enables Multi-Asset Diversification

TAP Invest was built for this new era, where traditional finance meets digital innovation. The platform enables investors to access a wide range of digital assets, tokenized RWAs, and tokenized commodities such as gold and silver within a transparent, compliant framework.

Our AI Portfolio Analyzer helps investors understand their personal financial situation and risk profile, while TAP Strategies enable data-driven portfolio decisions through subscription-based access across multiple asset classes.

With the ability for investors to connect their accounts, such as Robinhood, Charles Schwab, Fidelity, and E*TRADE, as well as leading digital exchanges such as Coinbase, Binance, Kraken, and more, TAP Invest delivers seamless strategies and access to both legacy and blockchain-native markets.

In the near future, fractional ownership will extend to income-producing real estate, infrastructure, private credit, and commodity-backed assets, offering yield, inflation protection, and diversification not available in traditional 60/40 portfolios.

This holistic approach moves beyond 60/40, empowering investors to build resilience across economic regimes, asset classes, and technological transitions. For more information on TAP Strategies, such as our TAP: Beyond 60/40, visit: www.TAPInvest.com/invest/#strategies

Final Thoughts

The 60/40 portfolio was built for an era of falling rates, stable inflation, and predictable correlations. That era is over. Investors now face persistent inflation, policy uncertainty, and rapid digital transformation, forces redefining how value is created and preserved. Portfolios anchored only in yesterday’s assumptions risk quietly underperforming tomorrow’s markets.

At TAP Invest, our mission is to help investors prepare for what’s next. By combining timeless principles of diversification with TAP Strategies and blockchain tokenization, we are creating access to the next generation of multi-asset investing, bridging traditional finance and the digital economy to build portfolios designed for resilience in the new cycle.

Brian Foote

CEO

TAP, Inc.

References

- J.P. Morgan Private Bank. “Beyond the 60/40 Mix: 3 Reasons to Consider Alternatives.” September 2025. privatebank.jpmorgan.com

- Morgan Stanley. “Rethinking 60/40 Portfolios for Asset Allocation.” 2024. morganstanley.com

- BlackRock. “Rebuilding 60/40 Portfolios with Alternatives.” 2025. blackrock.com

- CAIA Association. “The Spectacular Past and Concerning Future of the 60/40 Portfolio.” 2023. caia.org

- Investopedia. “Why a 60/40 Portfolio Is No Longer Good Enough.” 2016. investopedia.com

- iCapital. “Trading Places: Mapping the Impact of Alts in a Traditional Portfolio.” 2023. icapital.com

Disclaimer: This content is for informational and educational purposes only and does not constitute investment advice. Please conduct your own due diligence and consult a licensed financial advisor before making investment decisions.