TLDR-TAP Invest, powered by Social Trader (a registered Robo-RIA), provides multi-asset. multi-brokerage portfolio viewing and analysis across stocks, ETFs, digital assets (Bitcoin, Ethereum), tokenized real-world assets, stablecoins, and prediction markets (where legally available). Connect existing brokerage accounts (Fidelity, Schwab, E*TRADE) and crypto exchanges (Coinbase, Kraken, Binance) for unified portfolio viewing. Access pre-built model strategies like Beyond 60/40 for educational and informational purposes. AI continuously analyzes your complete portfolio and provides insights. Integration with TAP Wallet enables verified payments, while TAP Registry creates potential future opportunities for viewing tokenized authenticated assets.

TLDR-TAP Invest, powered by Social Trader (a registered Robo-RIA), provides multi-asset. multi-brokerage portfolio viewing and analysis across stocks, ETFs, digital assets (Bitcoin, Ethereum), tokenized real-world assets, stablecoins, and prediction markets (where legally available). Connect existing brokerage accounts (Fidelity, Schwab, E*TRADE) and crypto exchanges (Coinbase, Kraken, Binance) for unified portfolio viewing. Access pre-built model strategies like Beyond 60/40 for educational and informational purposes. AI continuously analyzes your complete portfolio and provides insights. Integration with TAP Wallet enables verified payments, while TAP Registry creates potential future opportunities for viewing tokenized authenticated assets.

Traditional investing forces impossible choices. Want to view Bitcoin alongside blue-chip stocks? Use separate platforms. Need real-world assets like tokenized gold with your equity portfolio? Another platform. Most traditional brokerages don’t show crypto. Most crypto exchanges don’t show stocks. The result: fragmented portfolios spread across five or more platforms, manual tracking in spreadsheets, and zero unified view of your complete financial picture.

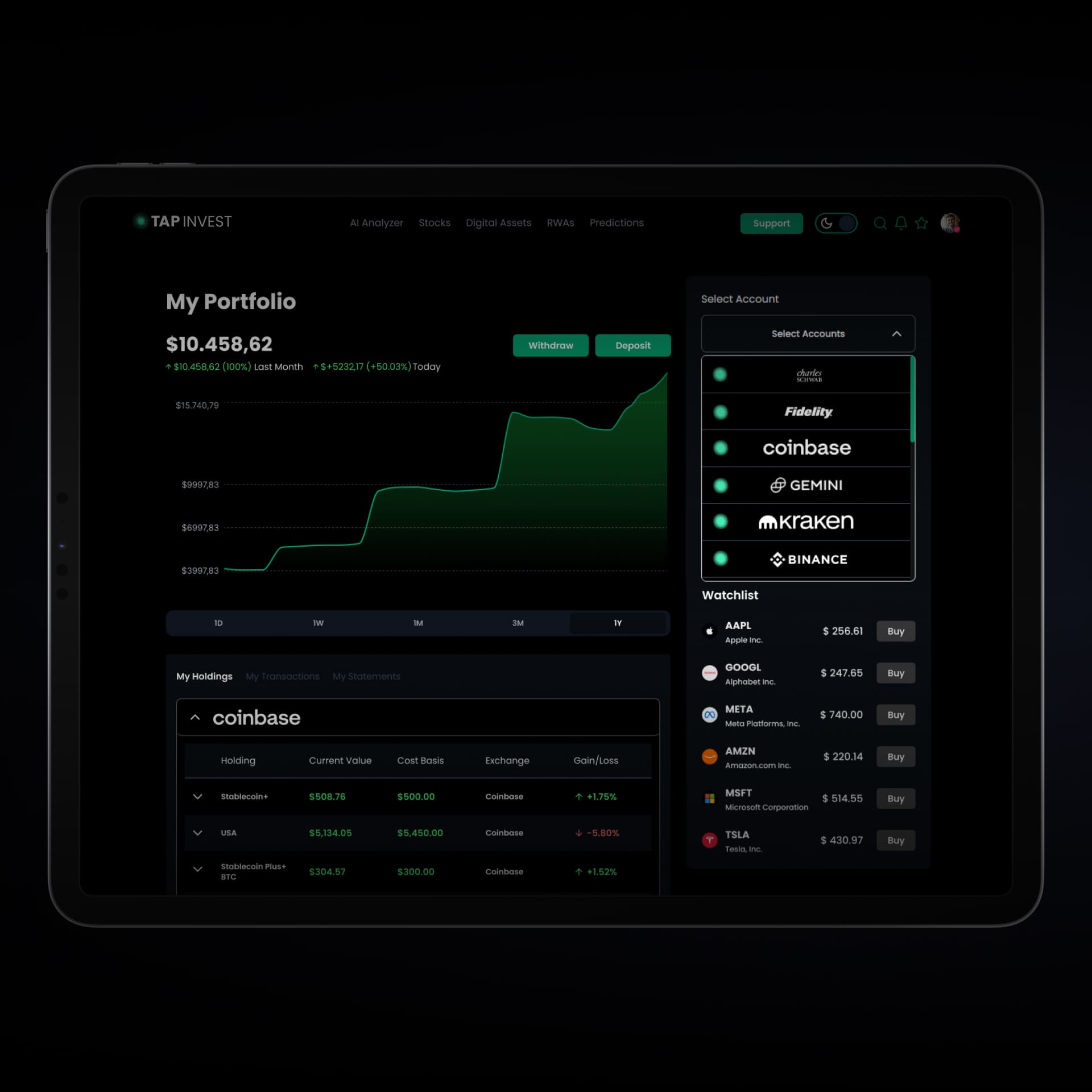

TAP Invest solves this through a single platform where stocks, digital assets, real-world assets, stablecoins, and prediction markets can be viewed together. Connect your existing brokerage and exchange accounts for unified portfolio viewing and AI-driven analysis across all asset classes.

The Multi-Asset Viewing Problem

Fragmented Platforms

Most traditional brokerages focus exclusively on stocks, bonds, and mutual funds. They don’t show cryptocurrency holdings, can’t display tokenized real-world assets, and have no visibility into prediction markets or decentralized finance positions. While some platforms like Robinhood have begun offering both stocks and crypto, true unified multi-asset viewing remains rare.

Most crypto exchanges operate in the opposite direction – showing digital assets excellently but offering zero visibility into traditional stocks, ETFs, or regulated securities. Want to see both? Maintain separate accounts, separate logins, separate interfaces.

No Unified View

When your portfolio spans Fidelity (stocks), Coinbase (crypto), and potentially other platforms for alternatives, you have no single source of truth. What’s your actual allocation across asset classes? How correlated are your holdings? Where are you overexposed? These questions require manual spreadsheet tracking that’s outdated the moment market prices change.

Zero Cross-Asset Intelligence

Even if you manually track everything, traditional platforms provide zero AI analysis across your complete portfolio. Fidelity analyzes your stocks. Coinbase shows your crypto performance. But nothing analyzes how these assets interact, identifies diversification patterns, or provides insights based on your complete financial picture.

This fragmentation creates friction through missed insights, hidden correlation patterns, and the sheer time burden of managing multiple disconnected accounts.

What TAP Invest Offers

Stocks & ETFs

TAP Invest provides comprehensive viewing of traditional equity markets with AI-driven portfolio analysis. View personalized stock portfolios and access model strategies blending growth, value, and dividend approaches. The platform analyzes holdings across sectors and regions, helping identify patterns aligned with different goals and risk tolerances.

AI continuously monitors visible equity holdings, assessing performance attribution, sector concentration, and correlation patterns. TAP Invest helps you understand portfolio construction and view how holdings may adapt to changing market conditions.

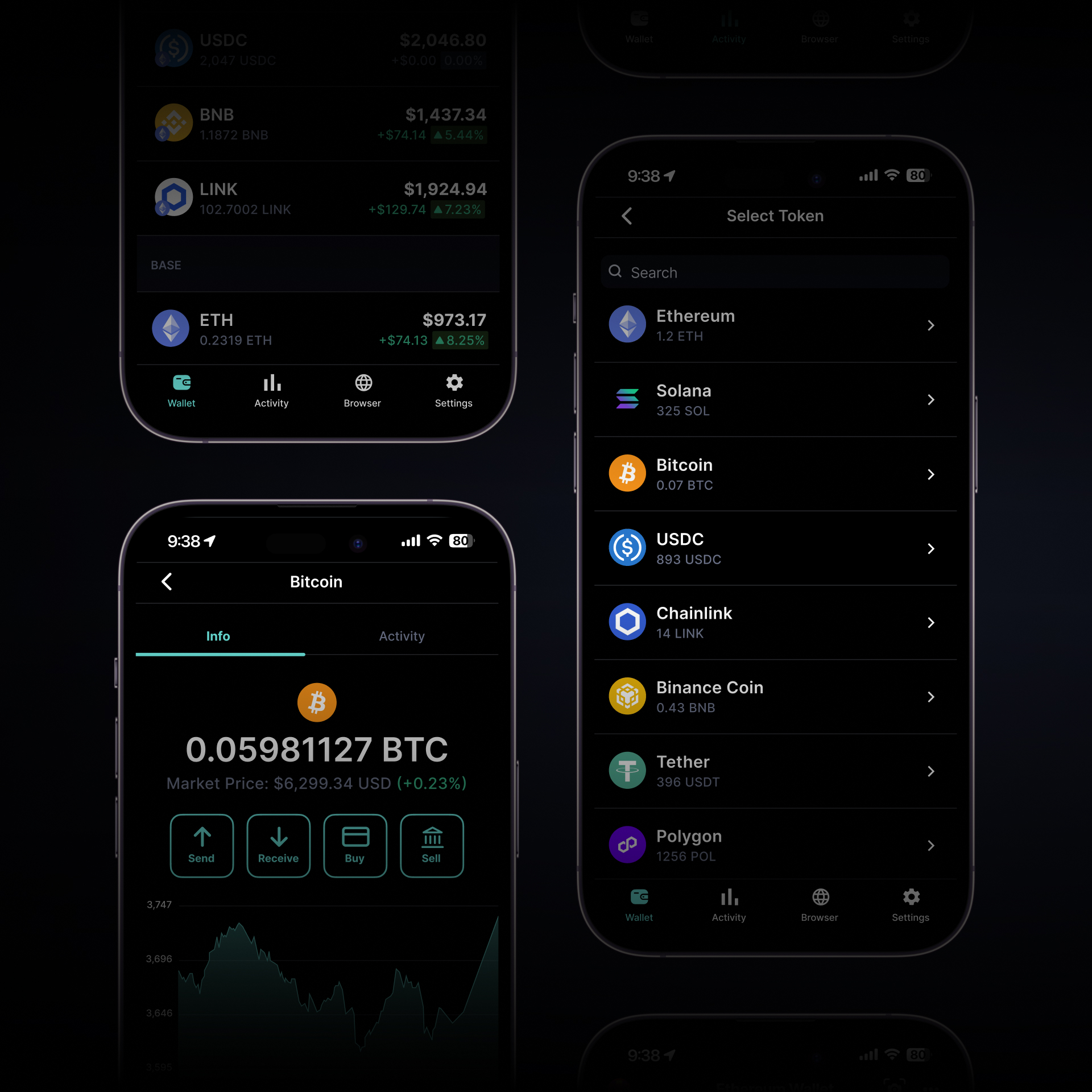

Digital Assets

View Bitcoin, Ethereum, Solana, and leading blockchain ecosystems through curated model portfolios designed for clarity and educational purposes. TAP Invest brings structure to digital asset viewing through AI models that continuously analyze trends, volatility, and market sentiment.

Rather than researching hundreds of cryptocurrencies individually, TAP Invest offers pre-built digital asset allocation models for different educational scenarios. Conservative crypto exposure? Moderate digital asset positioning? Aggressive blockchain ecosystem examples? View model strategies for informational purposes.

Digital assets are subject to significant price volatility and regulatory uncertainty. All digital asset investments carry substantial risk.

Real-World Assets (Tokenized)

TAP Invest bridges traditional and digital finance through viewing of tokenized real-world assets. View tokenized gold positions providing potential inflation considerations. Explore tokenized real estate for property exposure information. Consider tokenized private credit for alternative fixed-income educational models.

These assets bring tangible value considerations to portfolio viewing while maintaining the visibility benefits of tokenization. AI helps analyze allocations for stability patterns, inflation considerations, and long-term wealth preservation across your complete visible holdings.

Stablecoins & DeFi Yields

Stablecoins offer dollar-denominated stability with yield opportunities through decentralized finance protocols. TAP Invest provides viewing of stablecoin positions and educational information about DeFi strategies.

Important: Stablecoin yields are not FDIC insured and carry market risk including smart contract risk, protocol risk, and regulatory uncertainty. Stablecoins are subject to depegging risk and may lose value.

This creates a modern consideration in portfolio construction – relatively stable value with potential yield visibility, accessible 24/7 for viewing purposes.

Prediction Markets

TAP Invest provides viewing of prediction markets where positions on global events, policy decisions, and macro trends can be tracked (where legally available). AI analyzes probability data, sentiment, and correlations to help identify patterns.

Important: Prediction markets are subject to complex regulatory requirements and may not be available in all jurisdictions. Availability varies by location and regulatory status.

Prediction markets represent an emerging area for portfolio consideration. Whether it’s election outcomes, economic indicators, or policy decisions, prediction markets allow viewing of positions on future events, subject to applicable regulations.

AI Analyzer Portfolio Analysis

TAP Invest’s AI continuously monitors your complete portfolio across all connected accounts and asset classes. This isn’t simple performance tracking – it’s comprehensive analysis helping identify potential patterns, considerations, and optimization insights you might not spot manually.

The AI Analyzer evaluates correlation patterns between your holdings. Are your stocks and crypto more correlated than you realize? Is your portfolio showing concentration in specific macro areas? The AI flags these potential patterns proactively.

Performance attribution shows which holdings drive returns and which may drag performance. Risk assessment quantifies portfolio volatility patterns and suggests potential considerations. Analysis identifies when allocations drift from model targets. Alerts surface market conditions that may be relevant for specific strategies or assets.

All of this happens automatically in the background. You receive analytical insights for educational purposes when they may be relevant, not generic market commentary. The AI works continuously, providing sophisticated analysis designed to help inform your understanding of portfolio construction.

Note: AI analysis is provided for informational and educational purposes only. Analysis does not constitute investment advice, does not guarantee profitable outcomes, and does not predict future performance.

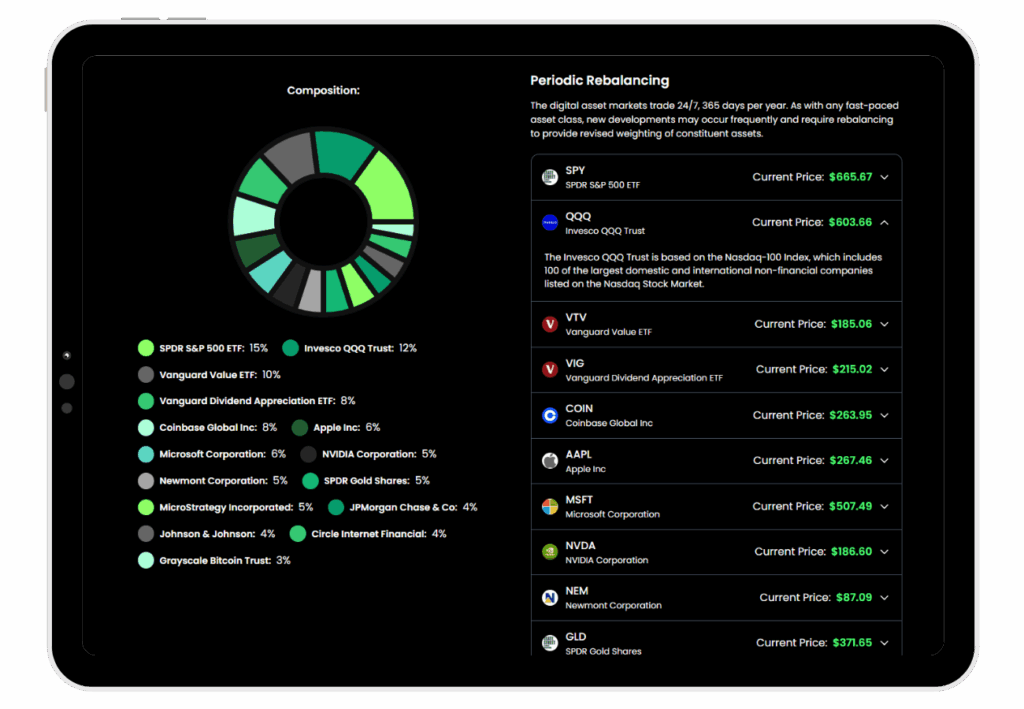

Model Strategy Viewing

Understanding that diversification may consider stocks, crypto, precious metals, and alternatives is one thing. Viewing how these might work together is another. TAP Invest provides educational model strategies showing how different asset allocations could be structured.

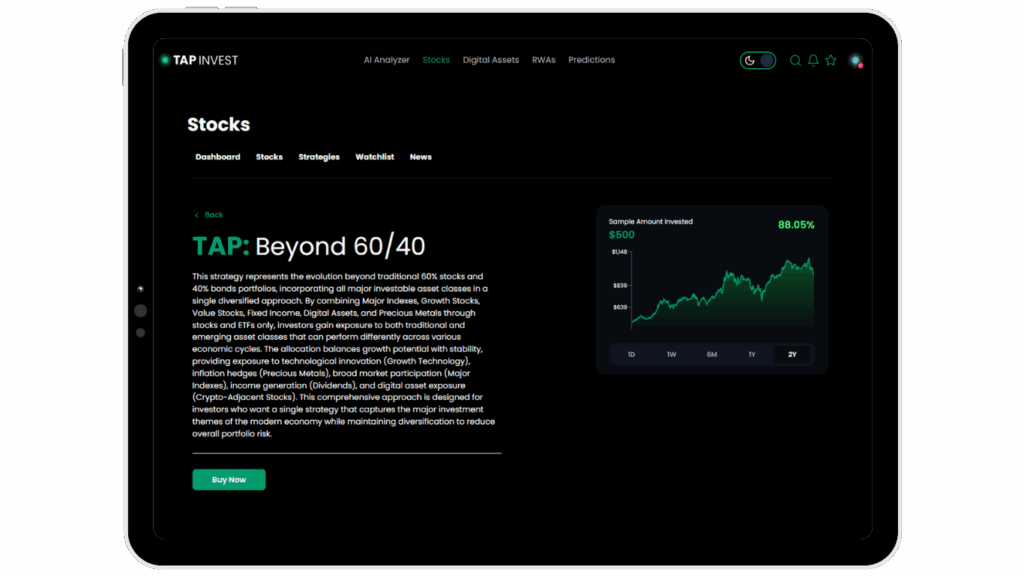

View pre-built model strategies like Beyond 60/40 to understand multi-asset portfolio construction. See complete holdings, allocation percentages, and how different asset classes might work together. These are educational models for informational purposes only.

Important: Model strategies are hypothetical examples for educational purposes. They are not investment recommendations, do not reflect actual trading, and past performance of models does not predict future results. Models shown may not be suitable for your situation.

How TAP Invest Works

1. Create Your Account

Get started in minutes. Set up your TAP Invest account quickly and securely to view both traditional and digital markets through a single unified platform.

2. Link Your Accounts

Connect your existing brokerage accounts (Fidelity, Schwab, E*TRADE, Interactive Brokers, Robinhood) and crypto exchanges (Coinbase, Kraken, Binance, Gemini). TAP Invest securely aggregates all holdings into one unified dashboard for viewing purposes.

Your assets remain in your brokerage and exchange accounts under your complete control. TAP Invest provides viewing functionality only.

3. View Model Strategies

Browse multi-asset model investment strategies designed for educational purposes. From conservative approaches to aggressive positioning examples, view model strategies for informational purposes aligned with different goals, timelines, and risk tolerance levels.

Each model strategy shows complete holdings, hypothetical historical illustrations (past performance does not guarantee future results), risk metrics, and asset class allocation. These are educational examples for informational purposes.

4. Access AI Analysis

View comprehensive AI analysis across your connected accounts. Track portfolio composition, receive AI insights about correlations and patterns, and access educational information – all from one unified viewing interface.

Powered by Social Trader: Robo-RIA Licensed & Regulated

TAP Invest is powered by Social Trader, a registered Robo-RIA (Robo-Registered Investment Advisor), providing technology for portfolio viewing and analysis. This licensing ensures:

Regulatory Compliance: Social Trader adheres to securities regulations and investment advisor requirements under the Investment Advisers Act of 1940, providing oversight and investor protection.

Fiduciary Standards: Social Trader is subject to fiduciary obligations when providing personalized investment advisory services (if enrolled in advisory services), operating in accordance with regulatory requirements for robo-advisors.

Institutional-Grade Security: Regulatory compliance includes security standards, operational controls, and investor protections that meet regulatory requirements.

Transparent Operations: Registration requires transparency about operations, fees, conflicts of interest, and business practices – ensuring you understand exactly how TAP Invest works.

Your assets remain in your connected brokerage and exchange accounts under your control. TAP Invest provides viewing technology, analysis, and educational information, but you maintain ownership and custody through your existing financial institutions.

For complete information about Social Trader’s services, fees, and approach, please review our Form ADV Part 2. Learn more about TAP’s regulatory framework and intellectual property.

TAP Invest in the TAP Ecosystem

Integration with TAP Wallet

TAP Wallet integration enables verified payments for potential future investment transactions. When funding accounts or executing trades requiring payment, TAP Wallet provides blockchain-verified payment records that could link directly to investment activities (subject to development and regulatory approval).

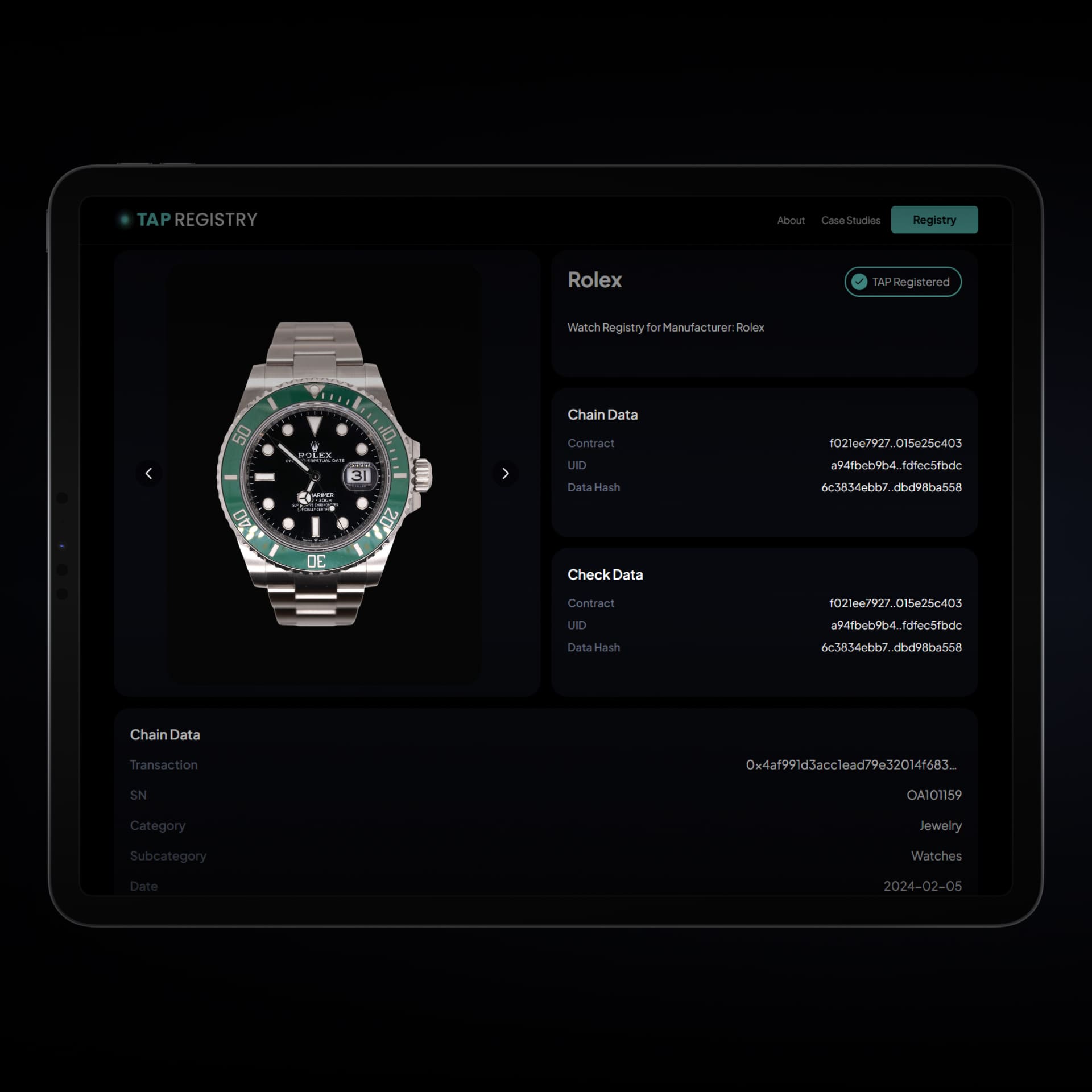

Integration with TAP Registry

Looking forward, TAP Registry integration may create potential opportunities for viewing tokenized authenticated assets, subject to regulatory approval and development. High-value items with blockchain authentication through TAP Registry could potentially be fractionally owned and tracked through TAP Invest in the future. These features are not currently available and would be subject to applicable securities regulations.

Complete Ecosystem

Understanding TAP’s complete ecosystem reveals how Invest, Wallet, and Registry work together. TAP Invest handles portfolio viewing and analysis across asset classes. TAP Wallet manages verified payments and transactions. TAP Registry authenticates assets for potential future tokenization. Together, they create infrastructure for authenticated commerce, secure payments, and multi-asset portfolio viewing – all built on blockchain technology.

Featured Model Strategies

Discover curated, model investment strategies designed for educational and informational purposes:

- Beyond 60/40: Educational model showing evolution beyond traditional portfolios combining stocks, digital assets, and precious metals

- Gold Plus Bitcoin: Model illustrating inflation hedge considerations and alternative stores of value

- Core Portfolio: Balanced multi-asset model foundation example for long-term growth illustration

- Stablecoin Models: Dollar-denominated examples (not FDIC insured, for educational purposes only)

- Digital Asset Ecosystem: Curated blockchain exposure models across leading networks

Each model strategy is viewable for educational purposes. Browse complete holdings, hypothetical performance illustrations (past performance does not guarantee future results), and risk metrics for informational purposes.

Explore TAP Invest’s model strategies →

What is TAP Invest and how is it different from traditional brokerages?

TAP Invest, powered by Social Trader (a registered Robo-RIA), provides unified viewing of stocks, ETFs, digital assets, tokenized real-world assets, stablecoins, and prediction markets (where available) through one interface. Unlike traditional brokerages focusing only on stocks or crypto exchanges handling only digital assets, TAP Invest connects your existing accounts across platforms and provides AI-powered analysis for viewing your complete portfolio. Current functionality focuses on account linking and portfolio viewing to help you make educated decisions.

What asset classes can I view through TAP Invest?

TAP Invest provides viewing of traditional stocks and ETFs, digital assets (Bitcoin, Ethereum, Solana, and leading blockchain ecosystems), tokenized real-world assets (gold, real estate, private credit), stablecoins with DeFi yield positions (not FDIC insured), and prediction markets for global events and macro trends (subject to regulatory availability). All asset classes are viewable through one unified platform with AI-driven portfolio analysis across your complete holdings for informational purposes.

How does the AI portfolio analysis work?

TAP Invest’s AI continuously monitors your complete portfolio across all connected accounts, analyzing correlation patterns, performance attribution, risk exposure, and potential considerations. The AI identifies patterns that may be relevant, surfaces information based on market conditions, and provides sophisticated analytical insights for educational purposes. Analysis happens automatically in the background, with informational insights delivered when they may be relevant. AI analysis is provided for educational and informational purposes only and does not constitute investment advice or guarantee outcomes.

Important Investment Disclaimers

Educational and Informational Purposes Only: Content provided through TAP Invest is for educational and informational purposes only and should not be construed as investment advice, a recommendation to buy or sell any security, or personalized financial advice unless you are enrolled in Social Trader’s investment advisory services.

Model Strategies: Model strategies shown are hypothetical examples for educational purposes only. They do not reflect actual trading, do not constitute investment recommendations, and are not suitable for all investors. Past performance of models does not guarantee or predict future results. Models may not reflect actual market conditions or trading costs.

Not a Broker-Dealer: TAP Invest is not a broker-dealer and does not execute trades. TAP Invest provides technology for portfolio viewing, analysis, and educational information only.

Account Linking: Current TAP Invest functionality focuses on account linking and portfolio viewing. Assets remain in your connected brokerage and exchange accounts under your control. TAP Invest does not have custody of your assets.

All Investments Involve Risk: All investments involve risk, including the potential loss of principal. Past performance does not guarantee future results.

Social Trader Registration: Social Trader is a registered Robo-RIA. For complete information about Social Trader’s services, fees, investment strategies, and potential conflicts of interest, please review Social Trader’s Form ADV Part 2.

Digital Asset Risks: Digital assets, including cryptocurrencies and tokenized assets, are subject to significant price volatility, regulatory uncertainty, and may lose substantial value. Digital asset markets operate 24/7 and may experience rapid price movements.

Stablecoin Risks: Stablecoin yields are not FDIC insured and carry market risk including smart contract risk, protocol risk, depegging risk, and regulatory uncertainty. Stablecoins may lose value and are not equivalent to bank deposits.

Prediction Market Risks: Prediction markets are subject to complex regulatory requirements and may not be available in all jurisdictions. Availability varies by location. Prediction market positions may result in total loss.

Future Features: References to future features including trade execution, tokenization, or other functionality are forward-looking and subject to regulatory approval and development. These features are not currently available.

Consult Professionals: Before making investment decisions, carefully consider your investment objectives, risk tolerance, and time horizon. Consult with a qualified financial professional regarding your specific situation.