Tap Platform as we ring in the New Year, we wanted to take a moment to reflect on a year in 2025 that marked a meaningful step forward for TAP, Inc. Together with our growing community, trusted partners, and early adopters, we made strong progress toward building a more unified, intelligent financial ecosystem for our TAP customers and corporate partners.

The regulatory environment for digital assets in the U.S. has never been stronger, and TAP is built precisely for this moment. As clarity increases and oversight matures, banks, broker-dealers, asset managers, payment networks, fintech platforms, custodians, and government entities are actively embracing blockchain as core financial infrastructure.

TAP sits at the intersection of this shift, delivering patented blockchain technology that unifies digital wallets, investing, payments, and registries into a scalable ecosystem.

What was once perceived as regulatory risk is now institutional momentum, and TAP provides the platform rails that enable customers and institutions to move forward with confidence, efficiency, and long-term scalability in a rapidly modernizing financial system.

What follows is a snapshot of what we accomplished together at TAP over the past year, and how we’ve been laying the groundwork for what comes next.

TAP Platform

The TAP Platform includes a suite of modular, financial technology products designed to be licensed and integrated across financial services markets.

These products, include the TAP AI Analyzer, TAURUS AI Agent, TAP Wallet, TAP Token Engine, TAP Smart Contracts, TAP Invest platform, and TAP Registry.

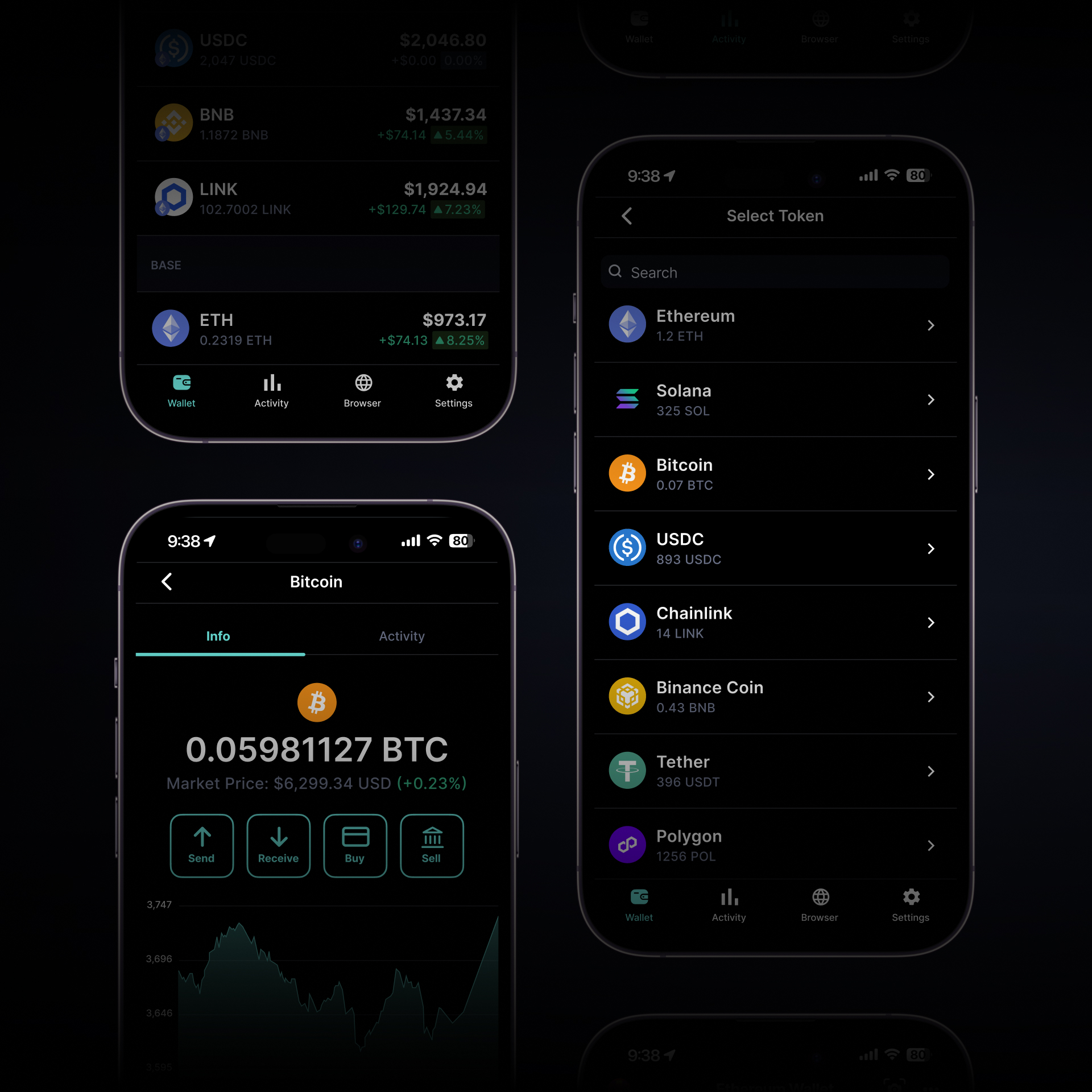

TAP Wallet

- Now supporting industry-leading networks including BTC, ETH, SOL, USDC, and more, giving users more flexibility.

- Continued enhancements to our secure, non-custodial digital wallet

- Improved send, receive, and asset management experiences across supported assets

- Ongoing focus on security, simplicity, and user-owned control

Throughout the year, we focused on strengthening the core wallet experience while laying the foundation for expanded utility and near-term future wallet capabilities as the platform evolves.

TAP Invest

- Significant expansion of brokerage and exchange connectivity across global markets

- Enhanced portfolio visibility across traditional and digital assets in a single, unified view

- Introduction of AI-powered analysis and insights to help users better understand performance, exposure, and market trends

TAP Invest now supports connections to leading brokerages and exchanges, including E*TRADE, Fidelity, Robinhood, Public, Webull, Coinbase, Kraken, Binance, Gemini, Questrade, Wealthsimple, Trading212, Stake, and more.

With these integrations, TAP supports brokerage connectivity for users across a growing number of regions and countries beyond the United States and Canada, subject to local brokerage availability and regulatory requirements in the following countries: United States Canada, Mexico, United Kingdom, Guernsey, Gibraltar, Isle of Man, Jersey, Austria, Belgium (limited services in certain cases), Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Switzerland, Sweden, Norway, Iceland, Liechtenstein, Kuwait, Oman, Bahrain, Qatar, United Arab Emirates, Angola, Ghana, Tanzania, Uganda, Zambia, Philippines, Colombia, Peru, Bolivia, Honduras, Ecuador, Moldova, Serbia, and North Macedonia.

This global expansion represents a major step toward our vision of unified, multi-asset investing without forcing users to abandon the platforms they already trust.

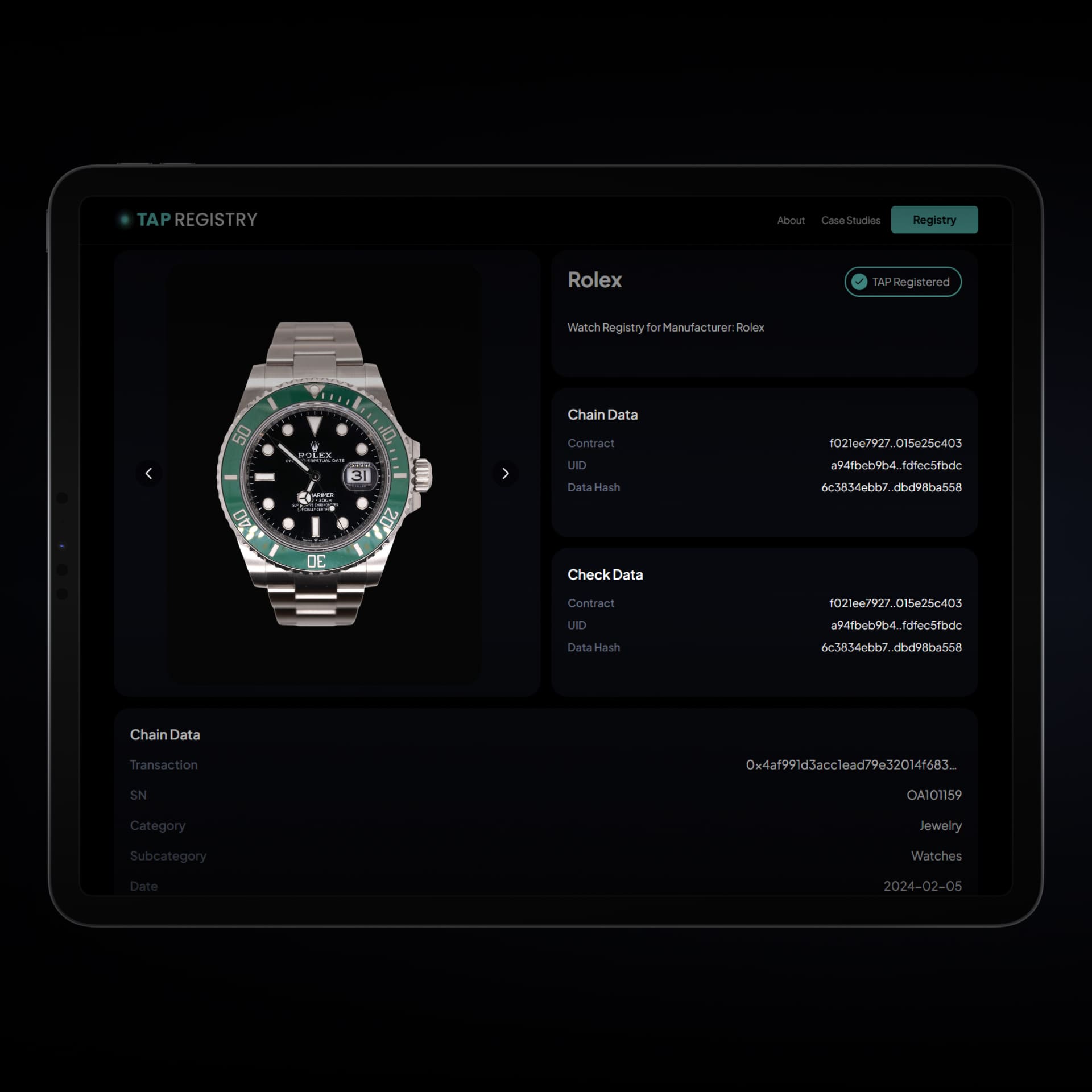

TAP Registry

- Blockchain-based registry for verifying, authenticating, and recording asset ownership

- Support for both real-world and digital assets

- Flexible metadata architecture with public, semi-private, and private registry options

- Built using Base, a modern, scalable Layer 2 blockchain, for efficiency, security, and long-term growth

TAP Registry establishes a trusted foundation for ownership, verification, and provenance, enabling new ways to prove authenticity, establish trust, and unlock value across physical and digital assets. Designed with flexibility at its core, TAP Registry supports public, semi-private, and private registry functionality, while TAP’s white-label capabilities enable seamless integration for enterprises, institutions, and government entities seeking secure, scalable, and customizable registry solutions.

TAP Intellectual Property

TAP holds key proprietary intellectual property that underpins key components of its digital wallet and blockchain technology platform, including U.S. Patent 12,118,613 – System and Method for Transferring Currency using Blockchain, filed in 2019, issued in October ‘24, with protections extending through 2041. With over $27 Trillion transferred on stablecoins last year, exceeding Visa and Mastercard combined, we see strong potential opportunities for patent licensing and implementation in the new year.

This patented framework supports TAP’s long-term innovation strategy and provides a defensible foundation for developing scalable, compliant, and secure blockchain-enabled financial and asset infrastructure. The patent reinforces TAP’s ability to build differentiated products across wallets, registries, tokenization, and transaction workflows, while enabling future licensing and enterprise integrations.

TAP also has a patent-pending U.S. Application No. 17/084,251 covering Comprehensive Buying, Selling, Trading , Tracking, Verification, Validation, Tokenization and Financial Services Using Blockchain, including the generation of specialized tokens representing bundled portfolios of multiple assets, such as tokenized Mutual Funds, and ETFs, also filed in 2020.

TAP’s intellectual property portfolio reflects a commitment to building durable technology that bridges traditional financial systems and modern blockchain networks, positioning the platform for sustained growth and expanded use cases over time.

TAP ‘26: Platform & Ecosystem Growth

These efforts in 2025 positioned the TAP Platform for meaningful expansion as we move into the next phase of growth in 2026 across consumers and corporate clients.

While 2025 was about building the foundation at TAP, 2026 is about unlocking what that foundation makes possible.

New capabilities, deeper integrations across banks, brokerages, and retail, and meaningful expansions across the TAP ecosystem are already underway

The pieces are in place, and there’s much more to come. Thank you for being part of the TAP journey. We’re excited for what’s ahead and look forward to growing the TAP ecosystem together in 2026.

The TAP, Inc. Team

Transact. Authenticate. Pay.