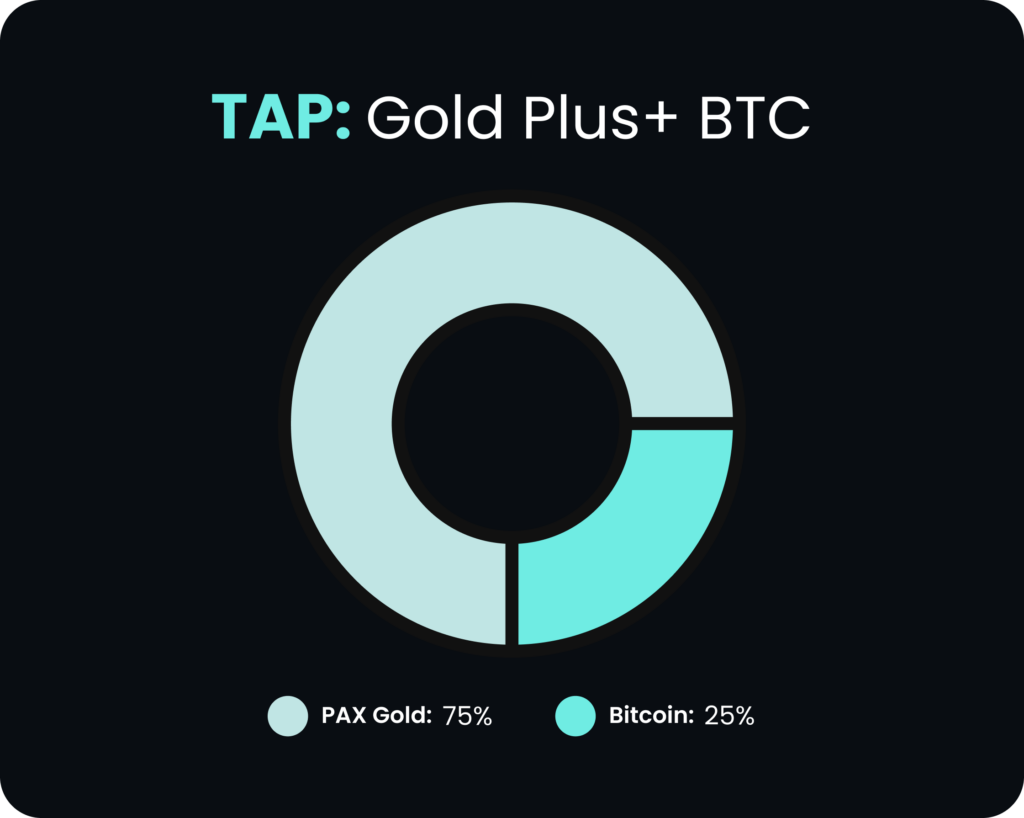

TLDR: The Gold Plus Bitcoin example allocation available on TAP Invest illustrates how two distinct asset characteristics are sometimes discussed together in multi-asset portfolio analysis. The framework references a 75 percent allocation to PAX Gold (PAXG), a tokenized representation of physical gold backed by LBMA-certified reserves held in institutional vaults, alongside a 25 percent allocation to Bitcoin, a digitally scarce asset with a fixed supply of 21 million units. Gold is often cited in financial literature as a long-standing store of value and inflation hedge, while Bitcoin is frequently discussed as a digital reserve asset with deep liquidity and growing institutional participation. This example is presented for educational and illustrative purposes to help explain how traditional and digital assets may be viewed together within broader portfolio conversations and does not represent investment advice or a recommendation to buy or sell any asset.

Why Traditional Safe Havens Face Challenges

Bonds in Rising Rate Environments

When interest rates rise to combat inflation, existing bonds can lose value. In 2022, global bond markets experienced significant declines as central banks increased rates aggressively. During such periods, bondholders may experience capital losses while inflation simultaneously reduces purchasing power.

Even when interest rates stabilize, bond yields may not keep pace with real inflation experienced in everyday expenses such as housing, healthcare, and food. This discussion is provided as general market context and does not imply that any asset class is suitable for any individual.

Cash Erosion Through Inflation

Cash provides liquidity but may lose purchasing power during sustained inflationary periods. Funds held in checking or low-yield savings accounts can decline in real value as prices rise. Even higher-yield savings accounts may deliver negative real returns when inflation exceeds nominal yields. The purchasing power of cash can decline over time depending on market conditions and individual circumstances.

How Markets Discuss Stores of Value

Market participants often examine assets that are discussed as potential stores of value when considering long-term purchasing power, currency risk, and economic uncertainty. This involves looking beyond traditional safe holdings and understanding how different asset classes have behaved across various economic environments.

Understanding the Gold Plus Bitcoin Example Allocation

The allocation described below is an illustrative example used solely to explain multi-asset portfolio concepts and does not represent a recommended portfolio.

The Example Allocation

The example consists of 75 percent PAX Gold and 25 percent Bitcoin. PAX Gold is a digital token that represents physical gold held in professional vault custody under the issuer’s framework. It provides digital exposure to gold price movements without direct physical handling, subject to market, custodial, and counterparty risks.

Bitcoin is a digital asset with a fixed maximum supply of 21 million coins. It operates on a decentralized network and trades continuously across global markets.

Why This Ratio Is Used as an Example

This ratio is commonly referenced in educational discussions to illustrate how assets with different characteristics can influence overall portfolio behavior. A higher allocation to gold may contribute to lower overall volatility relative to a smaller allocation to a more volatile digital asset such as Bitcoin. The example demonstrates how differing weightings can affect exposure without implying any specific outcome.

TAP Invest enables users to view and compare illustrative allocations without executing trades or providing recommendations.

Understanding Each Component

PAX Gold

PAX Gold tokens represent claims on physical gold held in professional vault custody by the issuer, subject to applicable terms and conditions. Tokenization is often discussed for its convenience features such as continuous trading availability, fractional ownership, and faster settlement compared to traditional physical gold transactions. These features also introduce additional considerations including issuer, custodial, and operational risk.

Bitcoin

Bitcoin has a fixed supply that is enforced through decentralized network consensus. This characteristic is frequently discussed in the context of scarcity and long-term monetary considerations, although outcomes are uncertain and subject to significant market risk. Bitcoin trades continuously and may experience rapid and substantial price movements.

Some institutions and publicly traded companies have disclosed Bitcoin holdings, reflecting increased examination of digital assets as part of broader asset discussions. Digital assets remain subject to regulatory uncertainty, market volatility, and the potential for significant or total loss.

Periodic Rebalancing as a Concept

Digital asset markets operate continuously, which can cause allocation weights to change over time as prices fluctuate. Rebalancing is commonly discussed in portfolio theory as a conceptual method for maintaining target weights within an allocation framework.

This discussion is provided for educational purposes only. TAP Invest does not execute, recommend, automate, or provide guidance regarding rebalancing or portfolio management.

Viewing Example Allocations Through TAP Invest

Understanding how gold and Bitcoin are discussed together in market commentary is one aspect of multi-asset education. TAP Invest provides a view-only platform where users can explore how an illustrative allocation is structured, examine its components, and understand how such examples are presented within broader multi-asset portfolio discussions.

TAP Invest does not provide investment advice, discretionary portfolio management, or trade execution. The platform is designed to present information and visualization tools that support learning and analysis.

Commonly Discussed Characteristics

Gold and Bitcoin are often referenced in discussions about inflation, currency risk, and diversification due to their differing characteristics. Gold is frequently associated with physical scarcity and long-standing market history. Bitcoin is often discussed in relation to digital scarcity and decentralized network design. Both assets exhibit price volatility and are subject to market, regulatory, and liquidity risks.

This example allocation concentrates exposure in two assets and may not be appropriate for all individuals or market conditions.

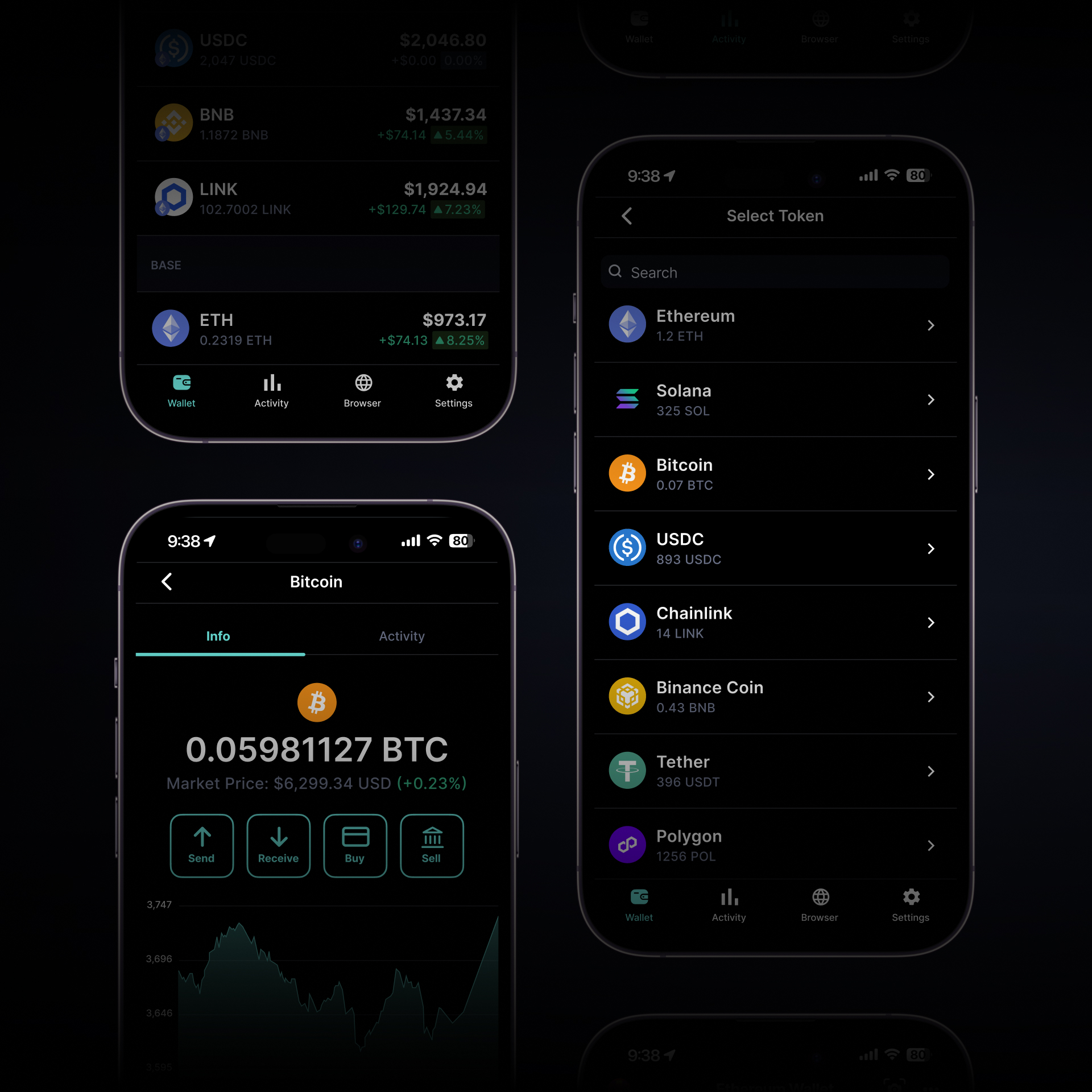

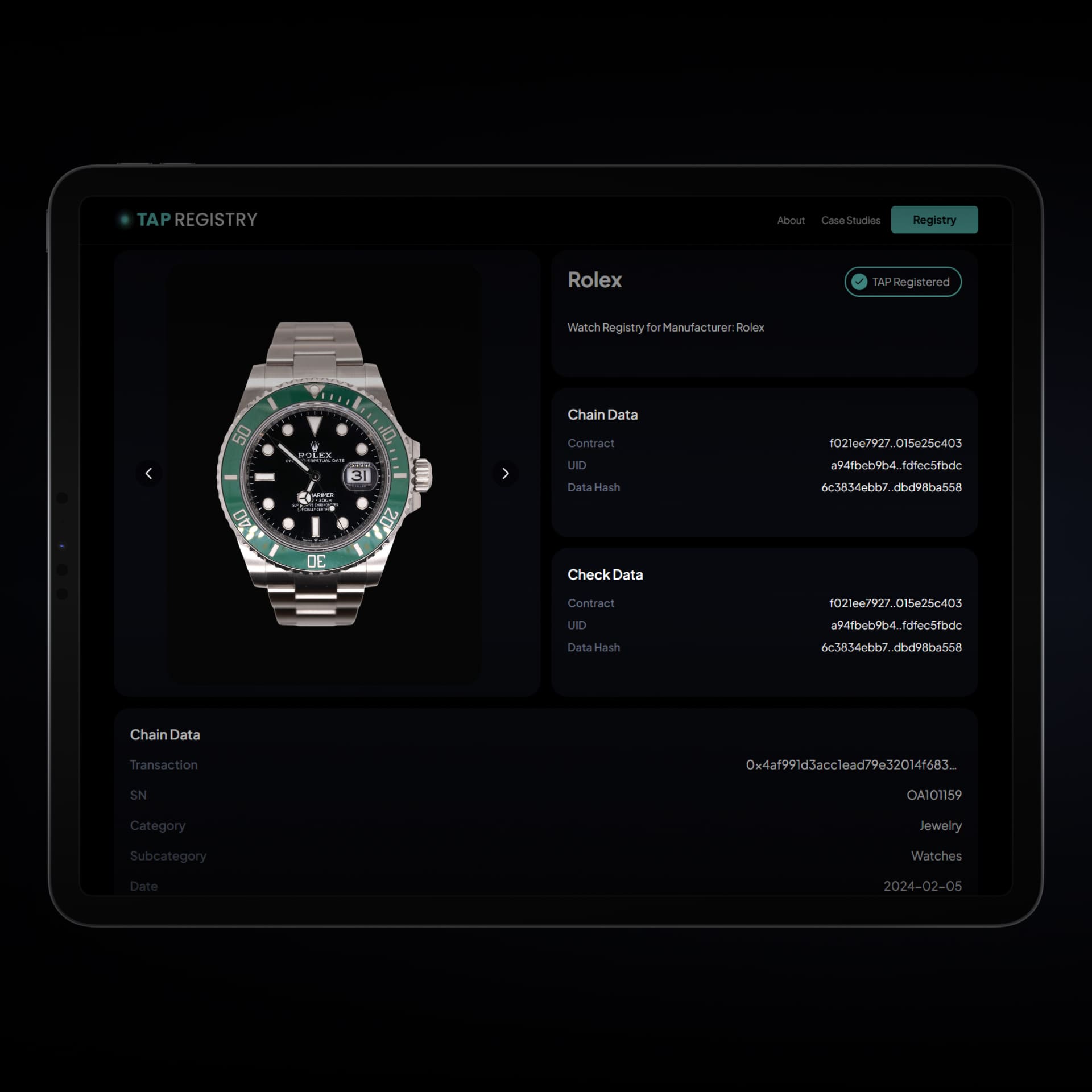

TAP Ecosystem Overview

TAP Invest operates alongside other components of the TAP ecosystem. TAP Wallet supports blockchain-verified transaction records where applicable. TAP Registry focuses on authentication and verification infrastructure. Together, these components provide tools for viewing, recording, and understanding digital and real-world asset data without providing investment recommendations.

What is the Gold Plus Bitcoin example allocation? The Gold Plus Bitcoin example allocation is an illustrative two-asset framework consisting of 75 percent PAX Gold and 25 percent Bitcoin. It is used for educational purposes to demonstrate how different asset characteristics are sometimes discussed together in multi-asset contexts.

Why is the example not evenly split? The 75 percent and 25 percent split is commonly used in educational discussions to illustrate how a higher allocation to one asset may influence overall volatility relative to a smaller allocation to another asset with different risk characteristics. It is not a recommendation.

How does TAP Invest support understanding this allocation? TAP Invest provides a view-only platform that allows users to explore example allocations, view connected account positions, and understand multi-asset portfolio concepts in a unified interface. TAP Invest does not execute trades or provide investment advice.

What are the risks associated with this example? Both gold and Bitcoin are subject to market risk and price volatility. Digital assets involve additional risks including regulatory uncertainty, technological risk, and the potential for significant or total loss. PAX Gold also carries issuer and custodial risks. Concentrating exposure in a small number of assets increases concentration risk.

Investment Disclaimer

The information provided is for educational and informational purposes only and does not constitute investment advice, financial planning, or a recommendation to buy or sell any security or digital asset. TAP Invest is a view-only platform. Digital assets, including Bitcoin and tokenized assets such as PAX Gold, are speculative and volatile and may result in significant or total loss of capital. Individuals should conduct their own due diligence and consult qualified financial professionals before making any financial decisions.