Case Study: The Slope

A blend of world-class architecture, immersive amenities, and four-season living, just minutes from Park City and Deer Valley.

Automated Blockchain Loan Repayment and Registry Recordation

A Modernized Technology Stack for Residential & Commercial Real Estate to Enhance the Automation, Payment, Liquidity and Settlement of Real World Assets (RWAs)

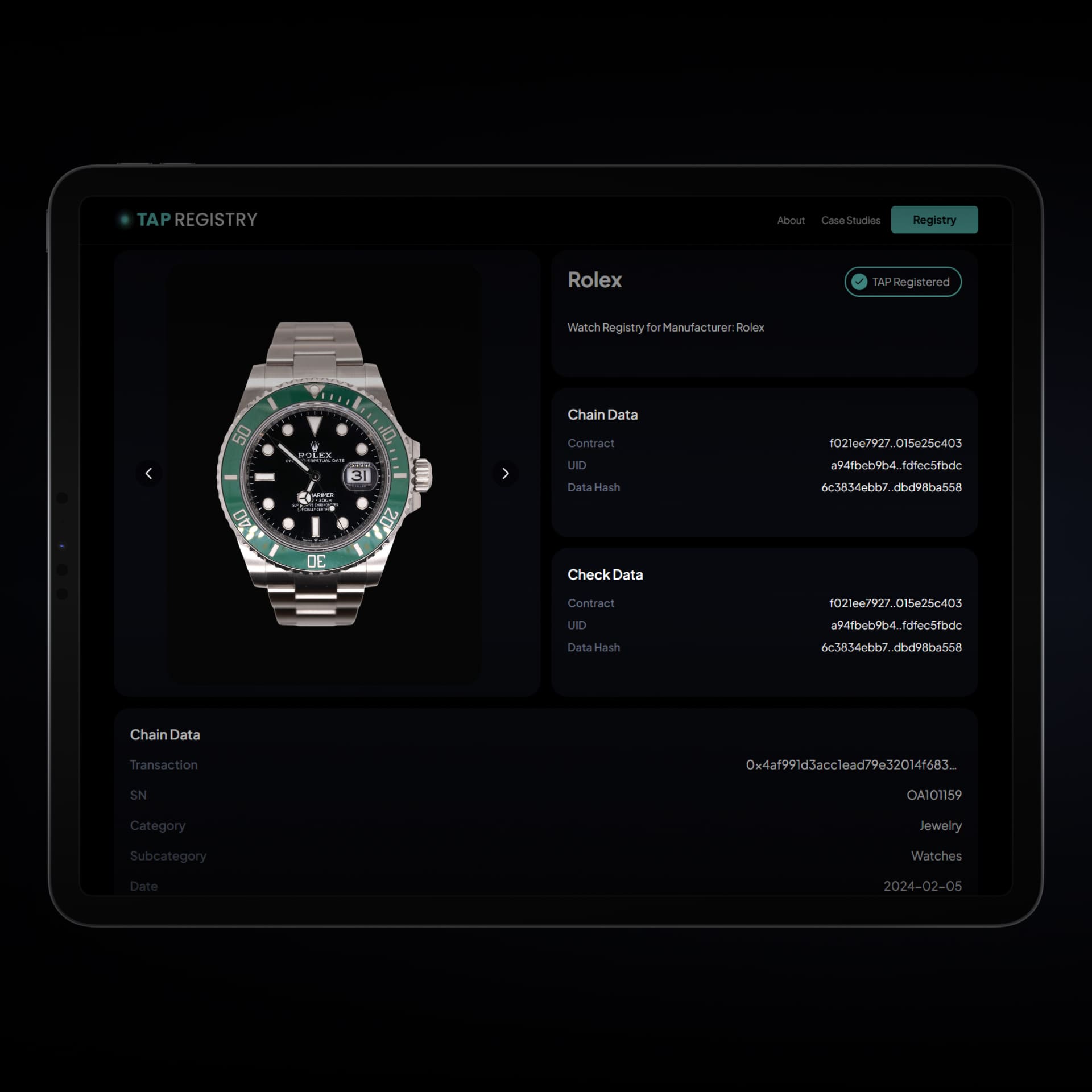

Using the patented TAP Platform for real estate payments and recordkeeping, a tokenized recordation of a $6.0 million loan principal and $300,000 in accrued interest was created and administered through the TAP Invest platform solely for payment execution, workflow automation, and registry purposes.

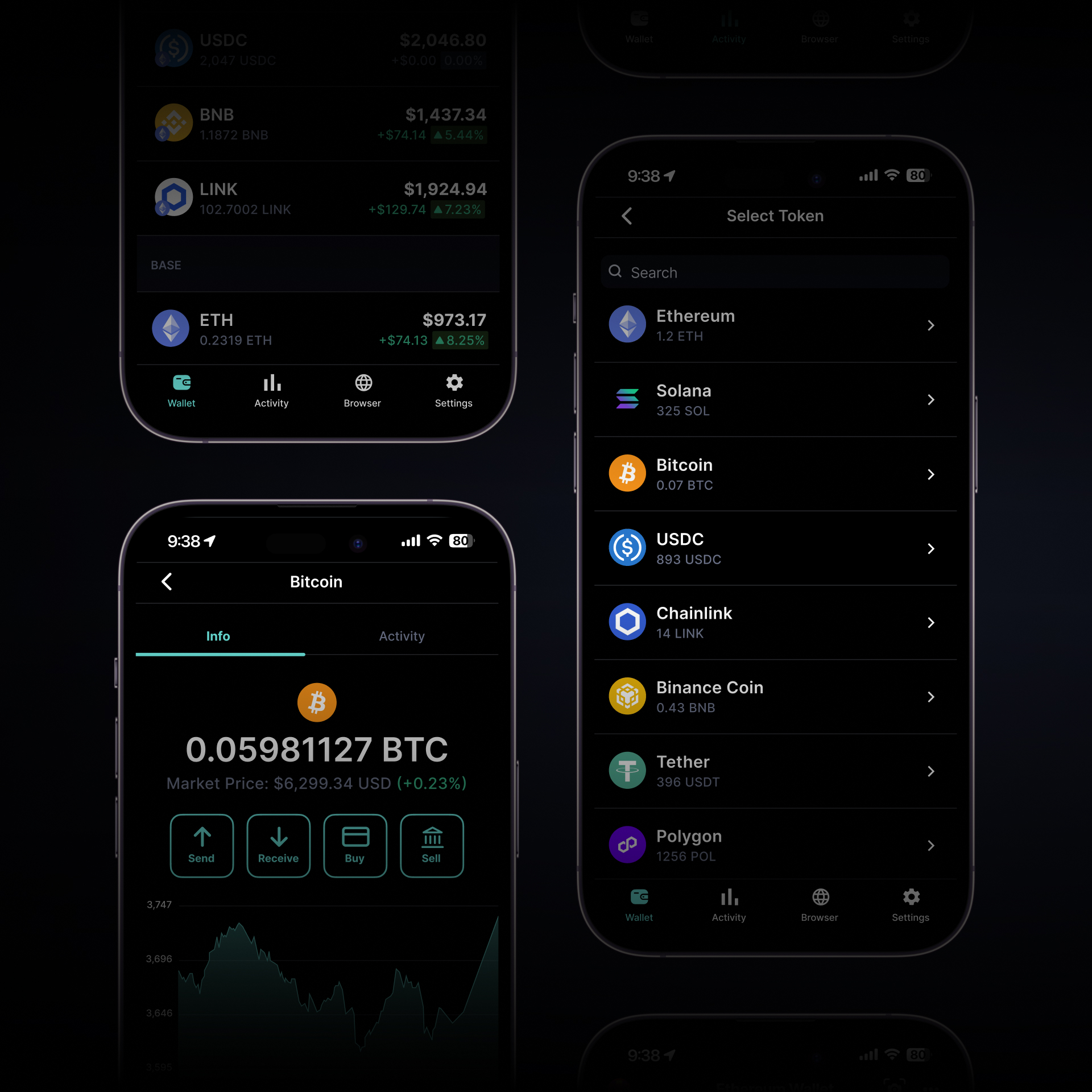

The borrower satisfied the loan obligation by initiating repayment through the “Repay Loan” function on the TAP platform. This action triggered a predefined smart contract workflow that automated the validation, authorization, execution, and confirmation of the repayment in accordance with the agreed loan terms. Upon borrower approval of the repayment amount and transaction details, the system executed the transfer of funds using TAP’s patented system and method for transferring currency using blockchain technology.

In parallel, the TAP Platform automatically generated a complete and immutable transaction record. All supporting documentation, payment metadata, authorization logs, and transaction history were digitally recorded and time-stamped within the TAP Registry. Registry access was configured in private, semi-private, or public modes, providing flexible disclosure and auditability depending on operational, contractual, or compliance requirements.

Operational and Modernization Benefits Demonstrated

This transaction illustrates how TAP’s patented platform modernizes core real estate financial operations by:

Improving accuracy and auditability through immutable, system-generated records that eliminate discrepancies between payment systems and repositories.

Reducing operational friction and administrative overhead by embedding payment execution, confirmation, and recordation into a single digital process.

Automating complex financial workflows that traditionally require manual processing, multiple intermediaries, and reconciliation across disconnected systems.

Creating a digital source of truth for loan documentation, payment history, and transaction evidence, supporting long-term asset management and reporting.

Accelerating settlement and close-out timelines, enabling real estate operators to manage debt service, repayments, and capital events with greater efficiency.

Set atop nearly 40 acres, The Slope is the newest hotel-branded mountain community in fast-growing Heber City.

- 140 Villas

- 62 Condos

- Year-Round Recreation

- Hotel-Branded Residences

Lifestyle & Recreation

Inspired by the refined calm of Kyoto and the service culture of premier Alpine resorts, The Slope delivers curated experiences steps from your door:

Winter: Skiing, snowboarding, and snow sports in nearby Park City.

Summer: Hiking, biking, and lake recreation across the Wasatch.

Village:Food, Family, Fun, and Fitness—retail and dining programmed for year-round energy.

On-site:Craft breweries, boutique shopping, and wellness spaces.

- Residences

- Villas

- Private, spacious floor plans with premium finishes.

- Flexible rentals: short-term and long-term (Airbnb, Vrbo, Hyatt, direct).

- Indoor-outdoor living with mountain and valley views.

- Condos

- Located within the hotel-branded luxury property.

- Access to full-service amenities and activated social spaces.

- Lock-and-leave convenience for owners.

Legal Disclaimers

- This transaction represented the on-platform recordation, repayment and automated settlement of a loan obligation using TAP’s patented blockchain-based system.

- The transaction was not marketed, structured, or offered to the public as a security, investment product, or capital raise, and no securities offering was made or implied.

- Any digital tokens, transaction records, or ledger entries utilized in connection with this repayment are non-tradeable, non-transferable, and non-fungible.

- The system was used exclusively to facilitate payment settlement, recordkeeping, and transparency between counterparties using blockchain technology.

This process was conducted exclusively as a commercial loan repayment and operational settlement function. No digital asset, token, or registry entry associated with this transaction was marketed, offered, or intended as a security or investment product. All digital records created in connection with this transaction are non-transferable, non-tradeable, and limited strictly to payment execution, documentation, and registry purposes.