Digital REIT Alternative

TAPs (Tokenized Asset Portfolios)

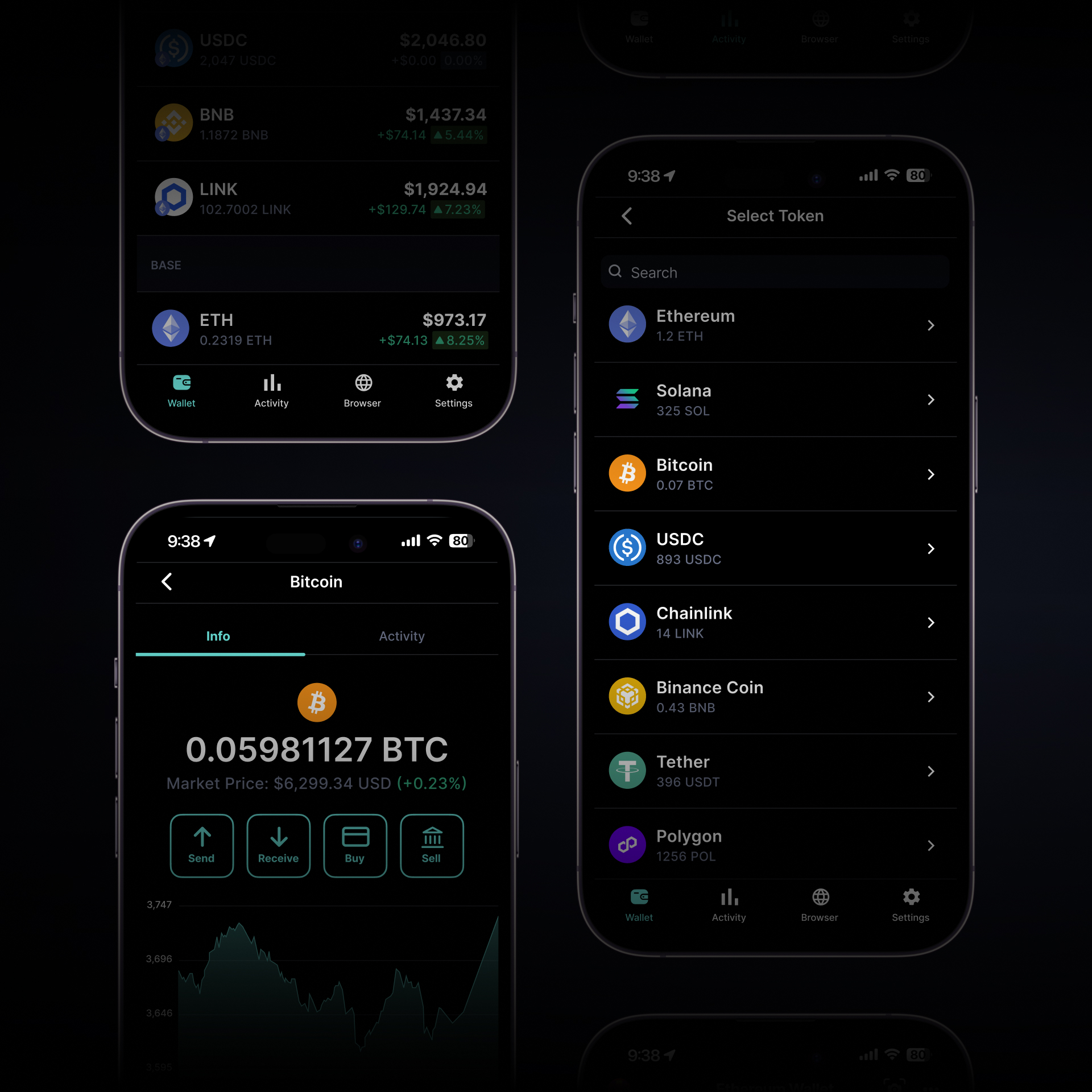

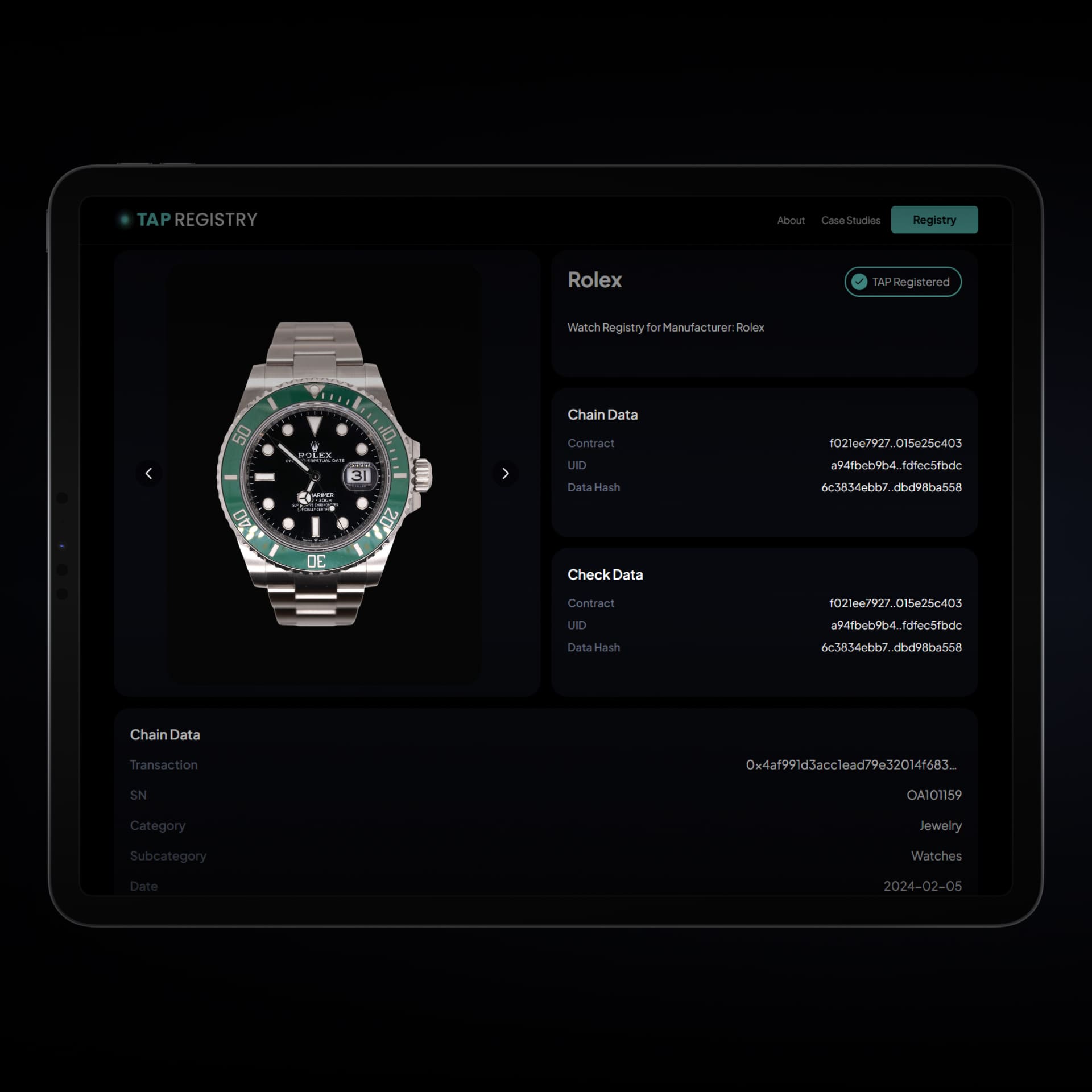

TAPs represent blockchain-native real estate investment structures designed as modern alternatives to traditional REITs. Rather than replicating legacy frameworks, TAPs are built from the ground up to operate on digital infrastructure, offering enhanced transparency, efficiency, and flexibility.

Traditional REIT Limitations

- Rigid distribution requirements

- Delayed reporting cycles

- Limited portfolio transparency

- High intermediary costs

- Complex governance structures

- Slow settlement processes

TAPs Advantages

- Flexible portfolio construction

- Real-time registry updates

- Clear ownership records

- Programmable distributions

- Streamlined administration

- Automated settlement