TLDR: TAP’s Beyond 60/40 strategy is a 15-position portfolio that includes 37% core market indexes, 17% growth technology, 12% financial infrastructure, 12% income and stability, 10% precious metals, and 12% digital asset exposure. This isn’t a guide for building your own portfolio diversification, it’s TAP’s proprietary strategy you can implement with one tap through TAP Invest’s platform, choosing your preferred brokerage for instant execution across all 15 positions simultaneously.

TLDR: TAP’s Beyond 60/40 strategy is a 15-position portfolio that includes 37% core market indexes, 17% growth technology, 12% financial infrastructure, 12% income and stability, 10% precious metals, and 12% digital asset exposure. This isn’t a guide for building your own portfolio diversification, it’s TAP’s proprietary strategy you can implement with one tap through TAP Invest’s platform, choosing your preferred brokerage for instant execution across all 15 positions simultaneously.

For decades, the 60/40 portfolio, 60% stocks and 40% bonds, was considered the gold standard of diversified investing. But in 2022, something changed. Both stocks and bonds fell simultaneously, with the S&P 500 declining approximately 18% and bonds falling about 13%. A traditional 60/40 portfolio lost roughly 16%, offering no meaningful protection. Investors realized a hard truth: the traditional approach no longer provides the diversification it once did.

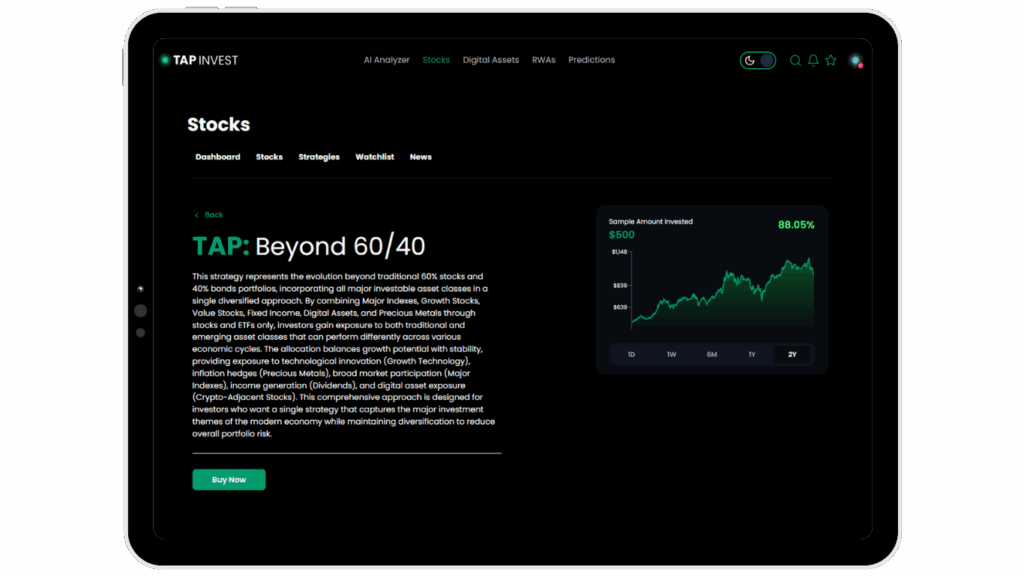

TAP Invest’s solution is the Beyond 60/40 strategy, a pre-built portfolio that combines major indexes, growth stocks, value stocks, digital assets, and precious metals across 15 carefully selected positions.

Why Traditional 60/40 Failed in 2022

The 60/40 portfolio worked from the 1980s through 2010s because stocks and bonds moved in opposite directions during volatility. When stocks declined, bonds provided stability through the flight-to-safety pattern.

2022 shattered this assumption. Inflation returned and central banks aggressively raised interest rates, hurting both asset classes simultaneously. Rising rates pressured stocks through higher borrowing costs while bonds declined because rising yields make existing bonds less valuable. The diversification benefit that made 60/40 reliable for decades broke down.

As we move through 2025, these challenges persist. Bond yields remain modest when adjusted for inflation, equity valuations sit at elevated levels, and the correlation between stocks and bonds remains unstable. Traditional 60/40 portfolios face structural headwinds.

TAP’s Beyond 60/40 Strategy: The Complete Allocation

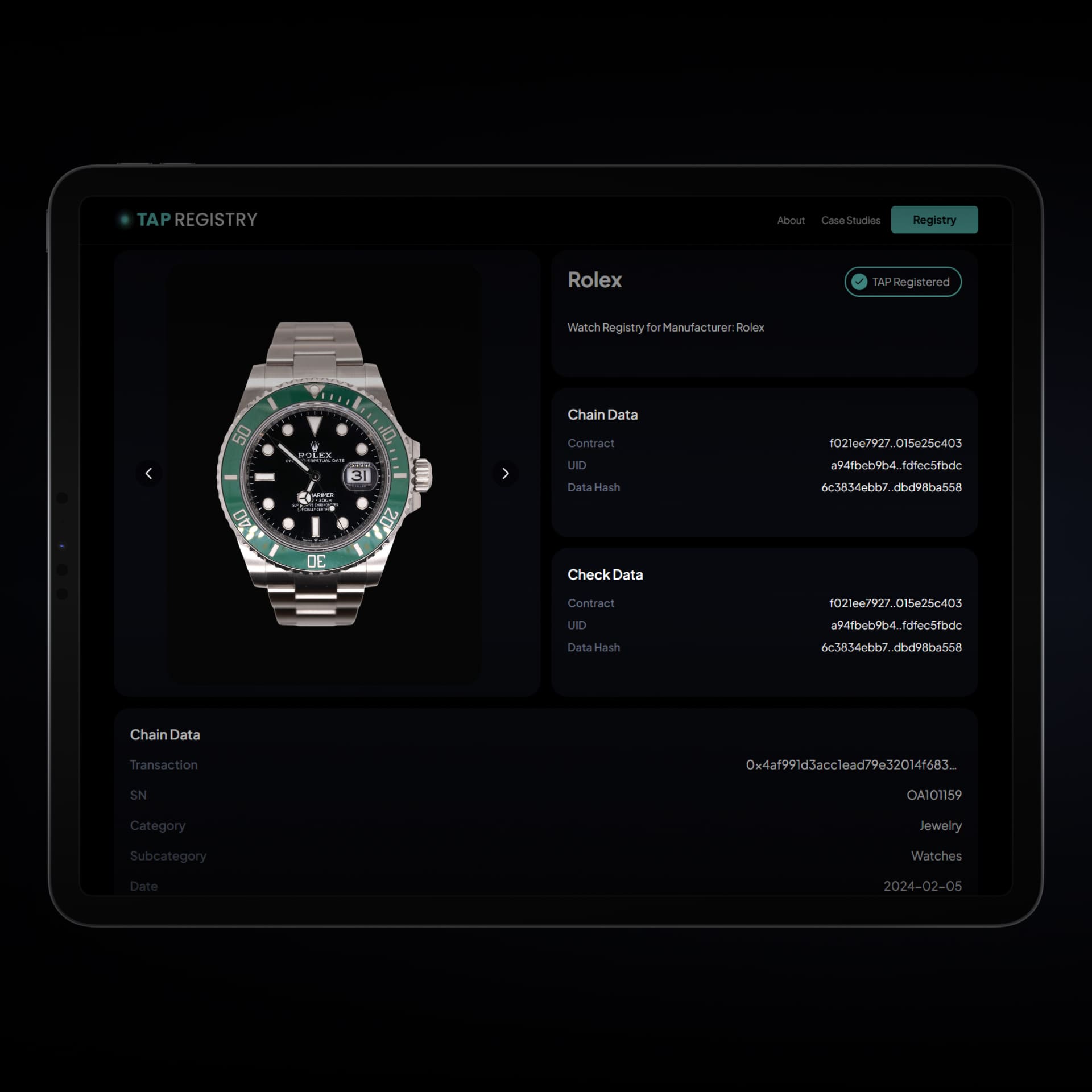

TAP Invest developed the Beyond 60/40 strategy to address these exact challenges. This isn’t a framework or guideline, it’s a specific 15-position portfolio you implement with one tap.

Here’s the exact allocation:

The 15 Positions

- SPDR S&P 500 ETF (SPY): 15% Broad market exposure capturing the 500 largest US companies.

- Invesco QQQ Trust (QQQ): 12% Technology-focused index providing exposure to innovative companies.

- Vanguard Value ETF (VTV): 10% Value stocks that balance growth-oriented holdings.

- Vanguard Dividend Appreciation ETF (VIG): 8% Companies with histories of increasing dividends for income generation.

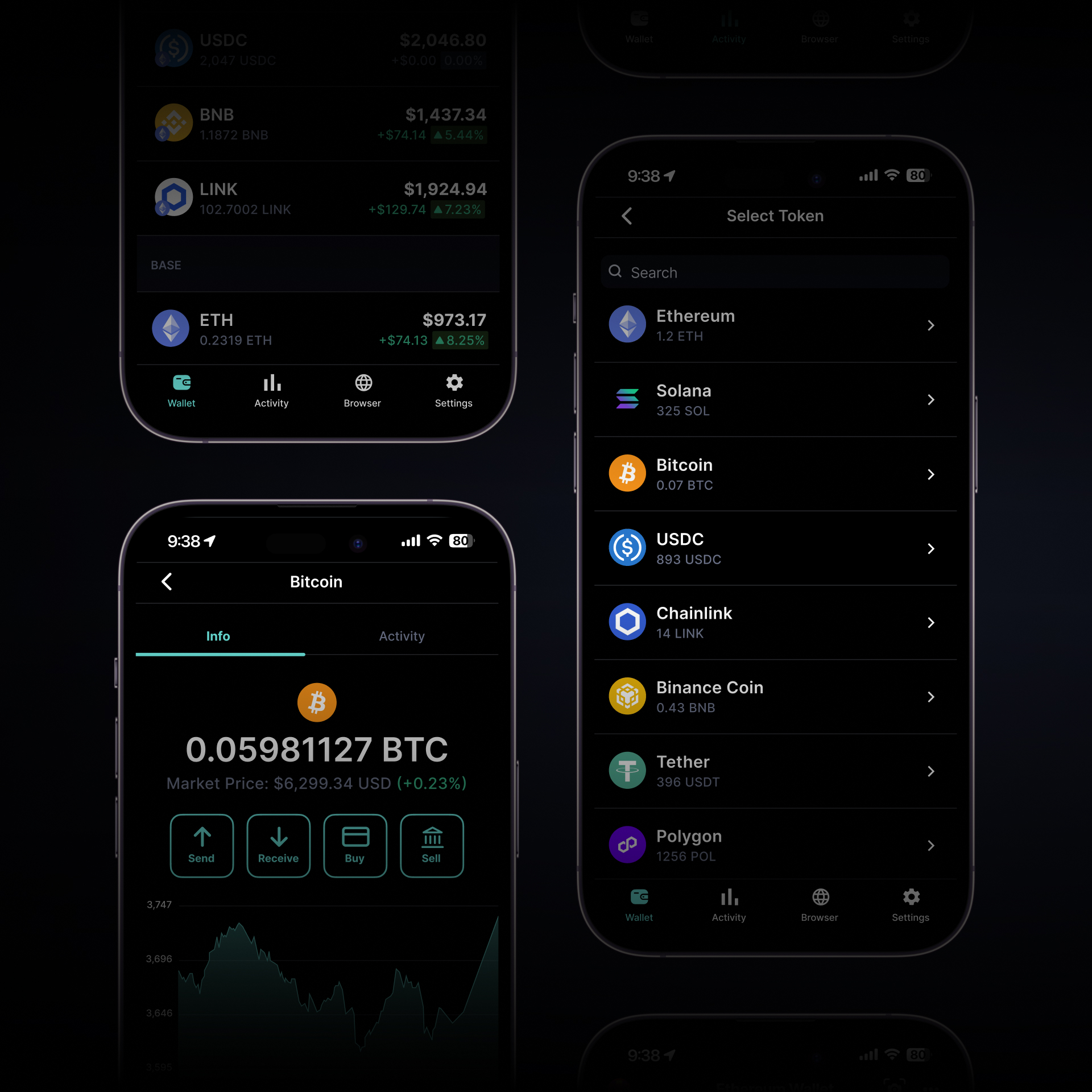

- Coinbase Global Inc (COIN): 8% Cryptocurrency exchange providing exposure to digital asset adoption.

- Apple Inc (AAPL): 6% Leading technology company with ecosystem dominance.

- Microsoft Corporation (MSFT): 6% Enterprise software and cloud computing leader.

- NVIDIA Corporation (NVDA): 5% GPU technology and AI infrastructure leader.

- Newmont Corporation (NEM): 5% Gold mining providing leveraged exposure to precious metals.

- SPDR Gold Shares (GLD): 5% Direct gold exposure for inflation hedging.

- MicroStrategy Incorporated (MSTR): 5% Corporate Bitcoin holdings providing digital asset exposure.

- JPMorgan Chase & Co (JPM): 4% Traditional banking infrastructure.

- Johnson & Johnson (JNJ): 4% Defensive healthcare for portfolio stability.

- Circle Internet Financial: 4% Stablecoin issuer benefiting from digital currency adoption.

- Grayscale Bitcoin Trust (GBTC): 3% Direct Bitcoin exposure through traditional security.

How the Allocation Works

- Core Market Exposure (37% total): SPY (15%) + QQQ (12%) + VTV (10%) provides broad equity participation across growth, value, and market-wide segments.

- Growth Technology (17% total): AAPL (6%) + MSFT (6%) + NVDA (5%) concentrates exposure in market-leading technology companies driving innovation.

- Income and Stability (12% total): VIG (8%) + JNJ (4%) generates income through dividends while providing defensive characteristics.

- Financial Infrastructure (12% total): COIN (8%) + JPM (4%) bridges traditional banking and digital asset infrastructure.

- Precious Metals (10% total): GLD (5%) + NEM (5%) provides inflation hedging and crisis insurance that bonds failed to deliver in 2022.

- Digital Asset Exposure (12% total): MSTR (5%) + Circle (4%) + GBTC (3%) captures Bitcoin appreciation through multiple vehicles.

TAP’s Beyond 60/40 strategy wasn’t built randomly. Each position serves a specific purpose, and the allocation percentages create balance between growth and stability.

The 37% in core market indexes ensures you participate in overall economic growth without being too contrarian. The 17% in leading technology companies (Apple, Microsoft, NVIDIA) provides concentrated exposure to the businesses actually driving productivity gains and innovation.

The 10% precious metals allocation addresses the exact problem that caused 60/40 to fail in 2022, when stocks and bonds fell together, gold provided genuine diversification. GLD and Newmont don’t move in lockstep with equities, offering protection during market stress.

Most importantly, the 12% digital asset exposure through Coinbase, MicroStrategy, Circle, and Grayscale Bitcoin Trust provided participation in an emerging asset class with low correlation to traditional markets. When Bitcoin rallied from 2023 lows, these positions drove significant outperformance. Yet even during crypto downturns, the 88% allocated elsewhere provided stability.

Multiple engines of return working simultaneously, some accelerating while others coasted, created the consistent upward trajectory visible in the performance chart. When technology stocks rallied, growth positions benefited. When inflation concerns persisted, gold provided ballast. When digital assets recovered, that 12% exposure paid off substantially.

One-Tap Implementation Across Your Brokerage

Here’s where TAP Invest eliminates implementation friction: you execute TAP’s entire Beyond 60/40 strategy with a single tap. No manual research, position size calculations, or executing 15 separate trades.

Simply select the Beyond 60/40 strategy, choose your investment amount, pick which connected brokerage account to use, and TAP Invest automatically executes all 15 trades simultaneously.

Investing $10,000? TAP Invest instantly calculates you need $1,500 in SPY, $1,200 in QQQ, $1,000 in VTV, $800 in VIG, $800 in COIN, and continues through all 15 positions with exact share quantities, then executes everything in seconds.

The positions live in your brokerage account under your complete control. TAP Invest simply removes all implementation friction, making it as easy to execute a sophisticated 15-position multi-asset strategy as it is to buy a single ETF.

Understanding TAP’s Strategy Design

TAP’s Beyond 60/40 strategy represents evolution beyond traditional portfolios by incorporating all major investable asset classes. As the strategy description explains, it combines “Major Indexes, Growth Stocks, Value Stocks, Fixed Income alternatives, Digital Assets, and Precious Metals through stocks and ETFs only.”

This comprehensive approach balances growth potential with stability. You get exposure to technological innovation through growth technology positions, inflation hedges through precious metals, broad market participation through major indexes, income generation through dividends, and digital asset exposure through crypto-adjacent stocks.

The allocation is designed for investors who want a single strategy capturing major investment themes of the modern economy while maintaining diversification to reduce overall portfolio risk. Rather than forcing you to choose between traditional and emerging asset classes, TAP’s Beyond 60/40 gives you both in one balanced allocation.

Multi-asset strategies like this have grown from less than $2 trillion in 2003 to about $16 trillion in 2023, representing approximately 13% of the $120 trillion global asset management industry. This growth reflects institutional recognition that single-asset-class approaches face significant limitations.

What’s changed is that platforms like TAP Invest now make institutional-quality strategies accessible to individual investors through one-tap execution.

What exactly is TAP’s Beyond 60/40 strategy?

TAP’s Beyond 60/40 is a pre-built 15-position portfolio. The strategy includes specific allocations: 15% SPY, 12% QQQ, 10% VTV, 8% VIG, 8% COIN, 6% AAPL, 6% MSFT, 5% NVDA, 5% NEM, 5% GLD, 5% MSTR, 4% JPM, 4% JNJ, 4% Circle, and 3% GBTC. You implement this exact allocation with one tap through TAP Invest, no manual position sizing or trade execution required.

How much digital asset exposure is in TAP’s Beyond 60/40?

TAP’s Beyond 60/40 strategy includes 12% total digital asset exposure through four positions: Coinbase (8%), MicroStrategy (5%), Circle Internet Financial (4%), and Grayscale Bitcoin Trust (3%). This allocation is built into the strategy, when you execute it with one tap, you automatically get this balanced 12% digital asset exposure as part of the complete portfolio.

Can I customize the allocations in TAP’s Beyond 60/40 strategy?

The Beyond 60/40 strategy is designed as a complete, balanced portfolio with specific allocations. While you choose your total investment amount, the percentages allocated to each of the 15 positions remain as designed. This ensures you’re implementing the exact strategy that achieved the documented performance results.

How do I implement TAP’s Beyond 60/40 strategy?

Log into TAP Invest, navigate to available strategies, select Beyond 60/40, choose your investment amount and preferred brokerage for execution, and tap execute. TAP Invest automatically calculates the exact number of shares needed for all 15 positions based on your investment amount, then executes every trade simultaneously on your selected platform in seconds.

How does TAP’s Beyond 60/40 compare to traditional 60/40 portfolios?

The strategy includes digital assets (12%), precious metals (10%), and concentrated technology positions (17%) that traditional 60/40 portfolios exclude, providing genuine diversification through assets with low correlation to each other.

Start with TAP’s Proven Strategy

The infrastructure exists today to implement this exact strategy in your account. The question isn’t whether portfolio construction will continue evolving, it will. The question is whether you’ll participate through proven strategies like TAP’s Beyond 60/40 or stick with traditional approaches that no longer provide reliable diversification.

Implement TAP’s Beyond 60/40 strategy with one tap, execute all 15 positions instantly →

Ready to get started?

Create free account – Sign up with your email

Connect your brokerage – Fidelity, Schwab, E*TRADE, Coinbase, others

Select Beyond 60/40 – Review TAP’s 15-position strategy

Execute with one TAP – Choose brokerage and invest instantly

Free to sign up. Implement TAP’s proven strategy in seconds.