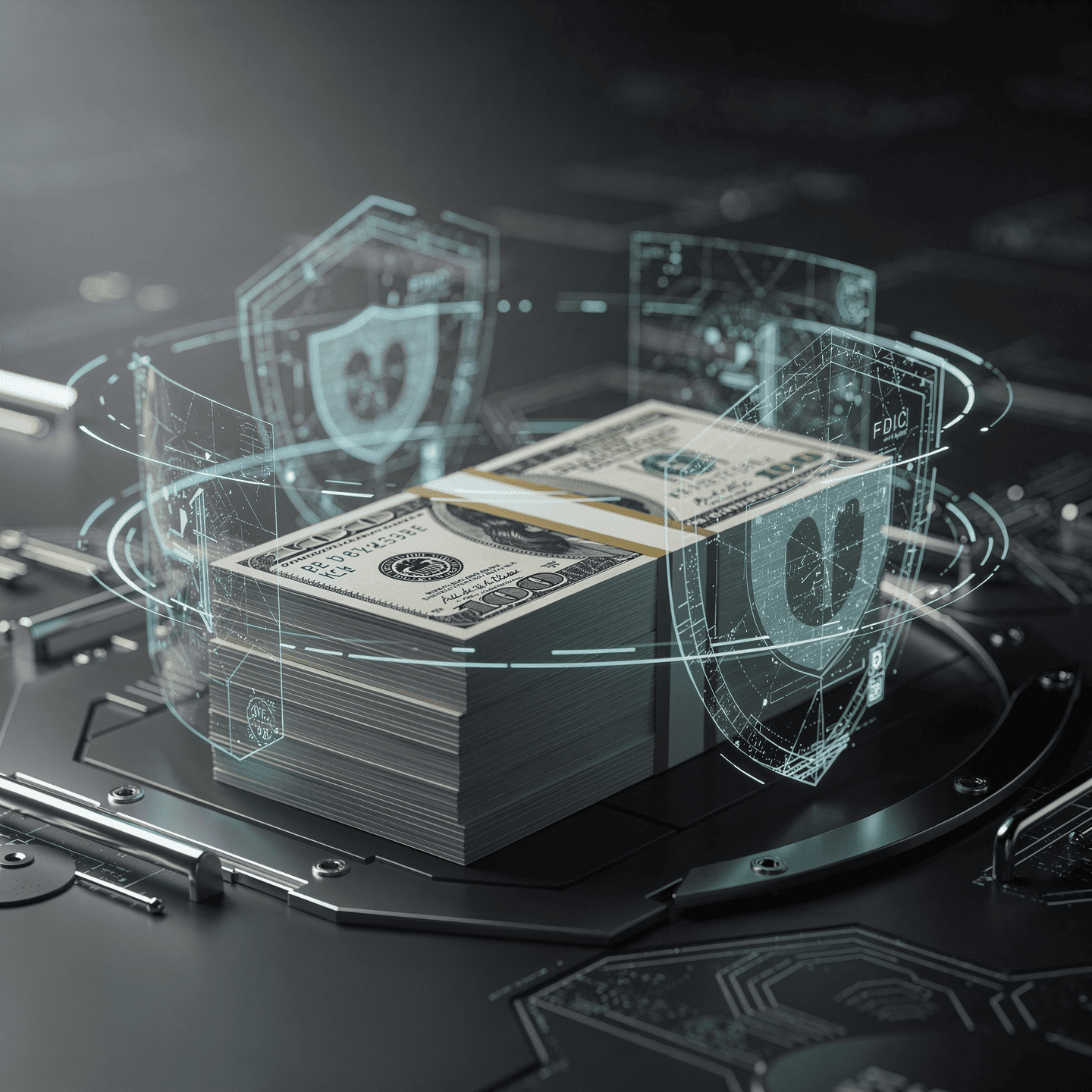

High Yield Cash Accounts

Your cash should do more than sit idle. Our high-yield cash account earns a competitive 3.50% APY, designed to deliver meaningful return while keeping your money fully liquid and protected. Unlike traditional savings accounts that barely keep pace, this account puts idle cash to work without locking it up or adding risk. Funds remain accessible whenever you need them, with FDIC insurance up to $250,000 for complete peace of mind. Whether you’re holding capital between investments, building reserves, or strengthening your financial foundation, this is a smarter way to store cash. No fees. No complexity. Just dependable yield, backed by security.

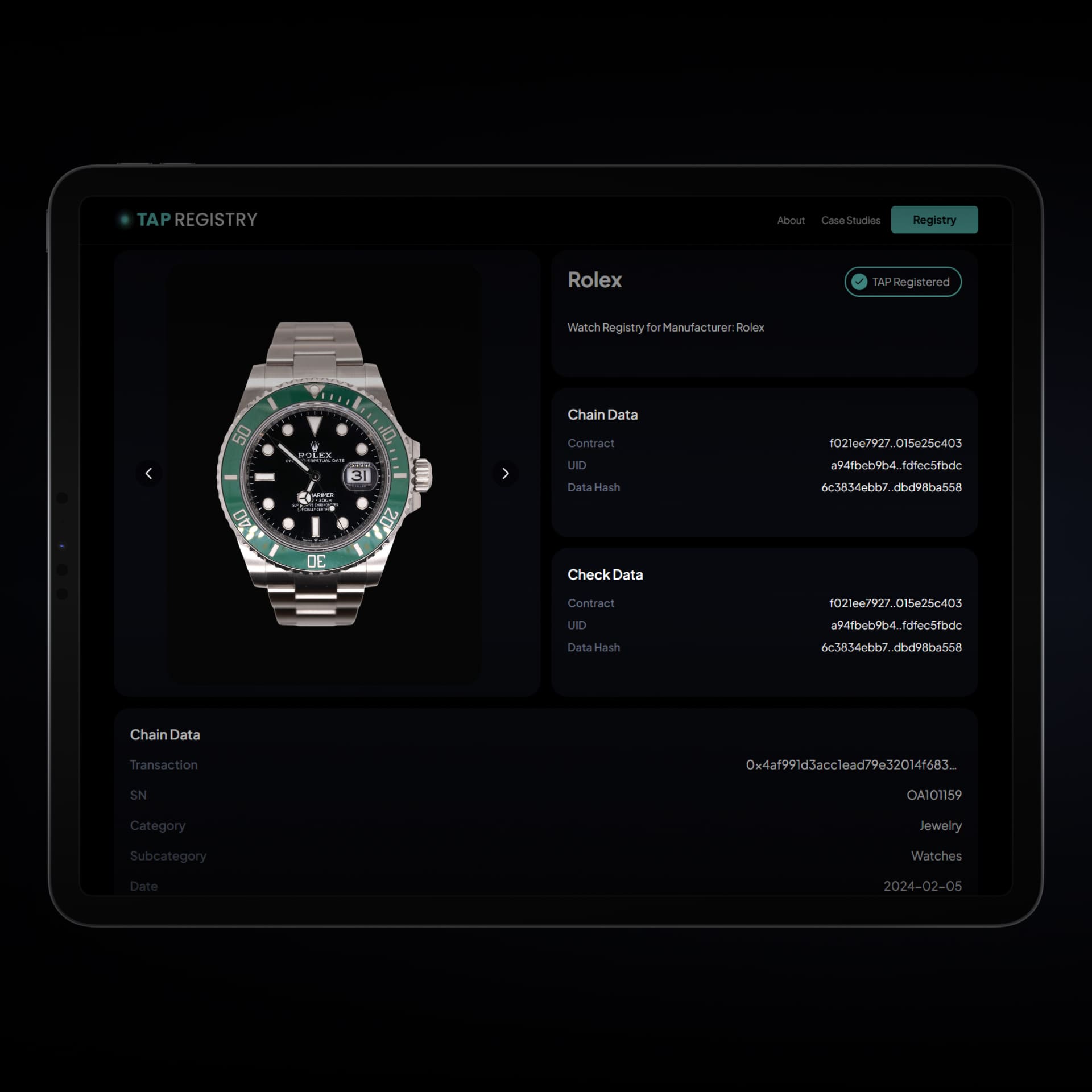

Improved Recordkeeping

Cryptographically verifiable ownership records eliminate reconciliation errors

Coordinated Payments

Automated settlement synchronized with registry updates

Efficient Settlement

Near-instant execution replaces multi-day clearing cycles

Built for Long-Term Growth

Simple & Secure

Cryptographically verifiable ownership records eliminate reconciliation errors

Perfect For

- Emergency funds that need to stay liquid

- Short to medium-term savings goals

- Cash reserves between investments

- Conservative investors seeking stability

Why Choose a High-Yield Cash Account?

In today’s financial environment, leaving cash in a traditional checking or low-yield savings account quietly erodes its value over time. A high-yield cash account closes the gap between basic savings and active investing, delivering meaningfully higher returns while preserving the security, liquidity, and stability essential to a strong financial foundation.

Government-Backed Security

FDIC insurance means your deposits are protected by the full faith and credit of the U.S. government, up to the maximum allowed limit.

Predictable Growth

Unlike market investments that fluctuate, your 3.5% APY is stable and predictable, making it easy to plan for your financial future.